Business Owners Insurance Planning When You Invest in a New Building or Major Renovation

Buying a building or funding a major renovation can be a big step for a business, but it also changes your risk profile immediately. Property values increase, contractors enter the picture, and timelines can create coverage gaps if policies are not updated promptly. A strong business owners insurance plan helps you protect the investment and avoid surprises when lenders, landlords, or vendors request proof of coverage.

Why Buildings and Renovations Change Insurance Needs

New property ownership changes what you are responsible for. If you previously leased space, you may have relied on a landlord for building coverage and certain maintenance obligations. Ownership can shift those responsibilities to you, including exterior, systems, and certain liability exposures.

Renovations add temporary risk. Construction materials, open walls, and changing access points can increase the likelihood of damage or injury. Your operations may also change during the project, such as relocating inventory, adding temporary entrances, or hosting customers in a partially renovated space.

Business Owners Insurance Items to Update First

A renovation or purchase is a good time to confirm the “numbers” on your policy match reality. Start with the basics:

Building and contents values

Confirm replacement cost values reflect current pricing and any planned improvements. Understated values can cause coinsurance issues or insufficient payouts.Tenant improvements and betterments

If you are renovating leased space, document what you own versus what the landlord owns. Limits should reflect what you would need to rebuild.Business income coverage

A disruption during a renovation can be expensive. Confirm how business income is calculated and whether limits reflect realistic downtime.

For a broader policy that is customized for your company, talk to an independent insurance agent who works with multiple carriers.

General Liability Insurance Questions During Construction

When contractors and vendors are involved, liability questions become more important. General liability insurance commonly supports third-party injury and property damage claims, but the details matter when job sites are active and multiple parties share responsibility.

Before work begins, confirm how you will manage certificates, additional insured requests, and contract requirements. If your business will remain open during construction, review how customer access will be controlled and how incidents will be reported.

Common Gaps to Avoid

Many renovation-related problems come from timing and documentation. Coverage can lag behind the project if the purchase date, closing date, or construction start date is not communicated clearly. Another common issue is failing to update values after improvements are completed.

Also watch for property that is temporarily stored off-site. If inventory is moved to a warehouse or storage unit, confirm it is covered and that theft sublimits are realistic. If equipment is stored in vehicles or trailers, confirm how that property is treated.

Key Takeaways

Building purchases and renovations increase property values and introduce contractor exposure.

Update building, contents, and business income values early, before work ramps up.

Manage certificates, additional insured requests, and timelines in writing.

Investing in a new building or major renovation is the right moment to pressure-test your policy assumptions, document project timelines, and confirm that values and contract requirements match how the space will be used when the work is finished.

Disclaimer: This content is for informational purposes only and does not constitute professional advice

General Liability Insurance Questions to Review Before Signing a Major Client Contract

A major client contract can be a growth milestone, but it can also raise your risk overnight. Higher revenue often comes with stricter insurance requirements, tighter deadlines for certificates, and contract language that shifts responsibility. Before you sign, use this general liability insurance checklist to confirm your coverage matches what the agreement expects.

Why Contracts Create Coverage Pressure

Contracts often require specific limits, additional insured status, and proof of coverage within a short window. Some agreements also include indemnification clauses that expand what you are agreeing to defend. Even when your operations do not change, a contract can change your financial exposure because it can define who pays first and who must respond when something goes wrong.

It is also common for requirements to be copied from larger vendor templates. That means you may see insurance language that does not match your work, or that asks for coverage that belongs elsewhere in your program.

Questions to Ask About General Liability Insurance

Use these questions to identify gaps before the contract is signed.

Do my limits meet the contract requirements?

Compare required per-occurrence and aggregate limits to what is shown on your declarations page.Will the contract require “additional insured” status?

If yes, confirm the policy can add the required wording and whether it applies to ongoing and completed operations.Are defense costs inside or outside the limit?

This can affect how much limit remains available if a claim becomes expensive to defend.Do exclusions affect the work described in the contract?

Review any exclusions related to your operations, products, or locations so you are not relying on assumptions.How will certificates be issued and tracked?

Confirm the certificate holder’s name, address, and deadlines, and keep a record for renewals.

For a plain-language look at why liability terms and endorsements vary across carriers, the NAIC’s consumer resources will help you understand how coverage components fit together.

How a BOP Fits Into Contract Requirements

Many businesses use a BOP as the foundation for liability and property coverage, but contract requirements can expose limits. If a contract requires higher limits than your base policy, you may need an umbrella or other adjustments rather than only raising the base limits.

A helpful reference for understanding common BOP components is here: https://www.iii.org/article/what-is-businessowners-policy-bop

Also confirm that your locations and operations are described accurately. If the contract changes where you work, how often you are on-site, or whether subcontractors are used, those operational changes should be documented so the policy assumptions remain accurate.

A Quick Pre-Sign Checklist

Before you sign, confirm these items match the contract language:

Required limits and aggregates

Additional insured wording and scope

Waiver of subrogation requirements, if any

Primary and noncontributory wording, if required

Certificate holder details and delivery timeline

If operational changes are needed midterm, keep documentation consistent with a written change request: https://hulettinsurance.com/client-center/request-policy-change/

Key Takeaways

Major contracts can expand exposure even if your daily work stays the same.

Review limits, additional insured wording, and exclusions before you sign.

A short checklist prevents last-minute certificate and endorsement issues.

Disclaimer: This content is for informational purposes only and does not constitute professional advice

Business Owners Insurance Advantages for Retailers and Boutique Shops

Retailers and boutique shops face a mix of customer traffic, inventory exposure, and property risk that can change quickly with seasons and promotions. Business owners’ insurance is often a practical foundation because it can bundle several core protections under one program. The details matter, though, especially for inventory values, theft exposure, and what happens when you run events or pop-ups.

Why Retail Risk Looks Different

Foot traffic increases the chance of slip-and-fall allegations, damaged merchandise, or third-party property damage. Shops also rely on inventory, fixtures, and point-of-sale systems that can be costly to replace. If your revenue depends on peak seasons, an interruption can hit hard, even if the physical loss looks small.

Retailers also face operational risks that don’t always show up in a renewal form. Examples include new product lines, higher inventory levels, store build-outs, or adding a second location for seasonal demand. When those changes are not documented, coverage assumptions can drift.

What Business Owners’ Insurance Typically Includes

A BOP commonly bundles property coverage and liability coverage. Property can help repair or replace certain business property after covered events. Liability often supports claims tied to third-party injury or property damage.

For retailers, the key is confirming how inventory is valued and whether sublimits apply to theft or certain types of property. It is also important to confirm whether tenant improvements are included and how business income is calculated if you cannot operate for a period of time.

This overview explains the typical structure of a BOP and why many small businesses use it.

How General Liability Insurance Supports Customer-Facing Shops

Retail exposure often centers on premises liability. General liability insurance commonly responds to third-party injury claims and certain property damage allegations. That matters when customers browse tight aisles, kids grab displays, or the weather creates slippery entryways. It also matters when your shop is part of a shared building. If the lease requires specific limits or additional insured wording, confirm that your program can support those requirements.

Common Gaps to Watch in Boutique Coverage

The most common gaps come from values and operations not being updated. If inventory increases for a holiday season, confirm that the limits and valuation basis are still adequate. If you store merchandise off-site, confirm whether off-premises property is covered and whether theft sublimits are realistic.

Another common gap involves temporary activities. Pop-ups, sidewalk sales, and in-store events can change exposure and contract requirements. If you bring in vendors, confirm how certificates and additional insured requests are handled.

A Practical Renewal Checklist for Retailers

Use this quick checklist before renewal:

Recheck inventory values and how the property is valued

Confirm theft and off-premises sublimits match reality

Review tenant improvements and new fixtures or displays

Update hours, staffing, and any new services or product lines

Collect lease and vendor contract insurance requirements

If changes are needed mid-term, a standardized written request helps keep documentation clean: https://hulettinsurance.com/client-center/request-policy-change/

Key Takeaways

Business owners’ insurance can bundle core protections retailers rely on.

Inventory values, theft sublimits, and tenant improvements are common friction points.

Regular reviews help keep coverage aligned as seasons and operations change.

Disclaimer: This content is for informational purposes only and does not constitute professional advice

Business Insurance Essentials for New Startups in Texas

Early-stage companies move fast. Hiring happens quickly, contracts get signed on short notice, and new equipment shows up before processes are fully documented. Setting up business insurance early helps protect the company while you’re still building systems.

This article focuses on practical essentials for Texas startups, including what to gather before you request quotes, what to review before signing client agreements, and how to avoid the most common early gaps.

Why Startups Need a Coverage Baseline

Startups often rely on a small team, limited cash reserves, and a few key contracts. A single loss can interrupt operations, delay deliveries, or force an expensive pivot. The goal of a baseline program is not to cover every hypothetical risk. It is to cover the most likely events that could disrupt operations, such as third-party injury claims, property damage, and common contract requirements.

An independent insurance agency can help you compare multiple carriers and explain how endorsements and exclusions differ across quotes. The Insurance Information Institute provides a plain-language overview of how independent agents work: https://www.iii.org/article/what-is-an-independent-insurance-agent

Core Business Insurance Coverages to Consider

Most startups start with liability and property fundamentals, then add coverage based on how they operate.

General liability: Commonly supports third-party injury or property damage claims.

Property coverage: Helps protect business property at a listed location, including certain equipment.

Business income: Can help replace income during a covered interruption.

Cyber-related coverage: Often needed when customer data, payments, or operations depend on systems.

Your exact mix depends on whether you have a physical location, whether clients visit your premises, and whether employees travel to job sites. If you use subcontractors, store equipment off-site, or ship products, your program may need additional endorsements.

What to Gather Before You Request Quotes

Quotes are more accurate when the inputs are consistent. As a best practice, build a habit of periodic reviews and midterm updates. If you need to submit operational changes in a standardized way, a written policy-change request process keeps documentation consistent.

Start with a short packet of information so proposals are comparable:

Legal entity name and ownership structure

Description of operations and how services are delivered

Estimated annual revenue and payroll by role

Address details, including leased responsibilities

Equipment lists and replacement cost estimates

Contract or vendor insurance requirements, if any

Common Early Gaps for Texas Startups

Startups often discover gaps when a client requests a certificate, a landlord requires additional insured wording, or a loss involves equipment away from the primary location. Another common issue is failing to update the policy after growth. Hiring, new services, and new locations can change exposure enough that the original policy assumptions no longer fit.

Key Takeaways

Startups benefit from a baseline business insurance program before growth accelerates.

Better quote inputs lead to more comparable proposals and fewer surprises later.

Update coverage when operations change, not only at renewal.

Disclaimer: This content is for informational purposes only and does not constitute professional advice

Why an Independent Insurance Agency Is Ideal for Seasonal and Project-Based Businesses

Seasonal and project-based businesses have a planning advantage and a coverage challenge. Operations change quickly, but policy details often lag behind. Crews expand, job sites move, and vehicles and equipment get used differently throughout the year. A practical business insurance program keeps pace with that reality, and an independent insurance agency can help you stay aligned when the calendar and workload shift.

Why Seasonal Operations Create Coverage Gaps

Seasonality changes exposure in predictable ways. Payroll spikes, job duties shift, and subcontractors get added for busy months. If the policy classifications and values are not updated, renewals can be built on last season’s assumptions. That mismatch can lead to delayed certificates, incorrect ratings, or confusion during a claim.

Project-based work adds contract pressure. Each job may require higher limits, specific certificate holder details, and additional insured wording. Those requirements tend to arrive fast, often right before work begins, when there is no time for back-and-forth.

How an Independent Insurance Agency Supports Changing Work

The advantage of an independent insurance model is flexibility and comparison. Instead of being limited to one carrier option, an independent insurance agency can evaluate multiple carriers and explain differences that matter in claims, not just premiums. That helps when underwriting appetite changes or when your risk profile looks different in peak season than it does in the off-season.

The Bankrate further explains how independent agents work and why comparing coverage is not always apples to apples.

Business Insurance Essentials to Recheck Before Peak Season

The fastest way to reduce surprises is to review the core building blocks and then focus on what changes seasonally. Many seasonal firms rely on a package policy as a foundation. If your program includes a BOP, confirm what is bundled and what must be added as exposures grow.

Liability deserves special attention when job sites, customer traffic, or vendor activity increases. If your peak season involves more public interaction, deliveries, or on-site work, review the basics of general liability coverage and limit requirements.

Next, confirm what happens when property leaves the premises. Tools and equipment that travel, as well as storage in vehicles or temporary sites, can create gaps if values grew but policy details did not. If you add trailers or change vehicle use seasonally, make sure schedules, driver lists, and radius assumptions still match reality.

A Simple Midseason Update Process

Seasonal businesses do best with a repeatable update routine. Track the changes that happen every year and report them early, before contracts and certificates pile up.

Update payroll and job duties by role for the busy season.

Confirm new locations, job types, or states where work will occur.

Review vehicles, trailers, and equipment values used in peak months.

Collect contract insurance requirements in one place.

Submit changes in writing so policy records stay clean.

A standardized change request process helps keep documentation consistent: https://hulettinsurance.com/client-center/request-policy-change/

If driving is a major part of your work, workplace fleet safety guidance can help reduce preventable incidents: https://www.nhtsa.gov/road-safety/workplace

Key Takeaways

Seasonal swings can change payroll, job duties, and locations enough to create gaps.

Independent comparisons help when one carrier’s appetite does not match your cycle.

A midseason update routine keeps business insurance aligned before peak exposure hits.

Disclaimer: This content is for informational purposes only and does not constitute professional advice

Business Insurance Tips for Family-Owned Companies Planning for Succession

Succession planning is more than choosing the next leader. It changes who signs contracts, who controls assets, and how day-to-day decisions are made. If insurance details lag behind those changes, small gaps can create expensive surprises. Use these business insurance tips to review what should be updated before ownership or management transitions.

Why Succession Planning Changes Risk

A transition often shifts operations in ways insurers care about. A new decision-maker may expand services, add locations, change vendors, or invest in equipment. Even if the work stays the same, documentation can drift. Named insureds, addresses, and payroll assumptions may no longer match reality.

Exit planning can also introduce timelines and triggering events, such as a sale, buyout, or leadership change. The U.S. Small Business Administration outlines practical considerations for owners preparing to exit a business, which can help frame what needs to be organized before the transition is underway.

Policies to Review Before a Transition

Start with the foundation. A quick read-through of your core coverages helps confirm that the “who, what, and where” are still accurate. A good starting point is the main overview of coverage types:

If you have a business owner’s policy, confirm whether it is still the right structure for the business. Many companies rely on a BOP as the base, but limits and endorsements may need to scale. This overview is useful for understanding common BOP components: https://www.iii.org/article/what-is-businessowners-policy-bop

Also confirm your liability base aligns with contracts and how you operate today. Premises exposure, subcontractor use, deliveries, and customer-facing activities can all change liability assumptions. If the transition includes new locations, new services, or new vehicle use, treat it as a midterm-update moment, not just a renewal note.

Operational Steps That Protect Value

Insurance updates go faster when your information is organized. Before a transition, collect a clean set of records so that underwriting, certificates, and claim handling are not delayed.

Confirm the legal entity name and ownership structure used on policies

Update property and equipment values, including tenant improvements

Recheck vendor and lease requirements for limits and wording

Document who is authorized to request changes and certificates

Review driver lists and any role changes that affect exposure

This is also a good time to identify what has changed over the last year. Annual insurance reviews are important if anything has changed or is expected to change soon, whether the difference was a gain or a loss.

How an Independent Insurance Agency Helps During a Transition

An independent insurance agency can help compare carrier options and keep policy assumptions aligned while leadership shifts. The practical value is coordination: updating entity details, adjusting limits, documenting changes for certificates, and avoiding “we’ll fix it at renewal” gaps.

Key Takeaways

Succession planning is a trigger to review business insurance details, not only leadership roles.

Keep entity names, locations, values, and authorized contacts current to avoid delays.

Review BOP structure, liability limits, and contract requirements before a transition is in motion.

Disclaimer: This content is for informational purposes only and does not constitute professional advice

Why Does My Business Owner's Policy Need a Tune-up?

When you first started your business, a business owner’s policy probably felt like a clean, simple solution. One policy, one bill, and a bundle that covered your space, your stuff, and many of the risks that come with working with customers. But the business you have today may look very different from the one you insured a few years ago.

That’s why it helps to give your coverage a periodic “tune-up.” With guidance from a local independent insurance agency, you can review your business insurance coverage and see where small tweaks to your business owner’s policy might make a big difference if something goes wrong.

What a Business Owner’s Policy Covers

A business owner’s policy (often called a BOP) is designed to bundle several key protections small businesses commonly need. While every company and policy is different, many BOPs include:

Property coverage for your building and business personal property.

Built-in general liability insurance for certain injury or damage claims involving others.

Some level of business income coverage if a covered loss shuts you down temporarily.

If you want a broader primer on how these pieces fit together, you can also skim anoverview of small business insurance basics from the Insurance Information Institute. It’s a good backdrop for conversations with your agent about what your own policy includes.

Why Your BOP Can Drift

Your business doesn’t stand still. You might expand your space, add new equipment, hire more employees, or start offering services off-site. Each change can affect what your business owners insurance should look like. If property values aren’t updated, limits that once felt generous may no longer reflect what it would cost to repair or replace everything today. If revenue has grown, your business income coverage might not match the income you’d need to replace during a serious shutdown.

The U.S. Small Business Administration also encourages owners to think ahead about disruptions and recovery; their guidance on preparing for emergencies is a reminder that policies should keep pace with how you actually operate.

Tune-up Moves to Discuss with Your Agent

When you meet with your independent agent for a policy review, a few focused tune-ups can go a long way toward protecting your time, money, and peace of mind. Together, you can look at how your general liability protection fits into the bigger picture and where your BOP needs an update. Common tune-up moves might include:

Updating property and equipment values so your limits better match current replacement costs instead of old purchase prices.

Adjusting business income coverage to reflect how long it might realistically take to reopen after a major covered loss, based on today’s operations.

Review your liability limits and deductibles to see whether they still fit your customer base, contracts, and risk tolerance.

Looking at property that leaves your premises—such as laptops, tools, or inventory—and deciding if your current coverage follows it where you actually work.

Confirming how endorsements and riders are set up so helpful extras—like certain equipment, utility, or code-upgrade protections—match your real-world risks.

You don’t have to sort through all of this alone. An independent insurance agency can review your policy line by line, explain how your BOP and general liability insurance work together, and highlight where a tune-up might deliver the most benefit for your type of business.

Disclaimer: This article is for general informational purposes only and is not legal, tax, or insurance advice.

Strengthen Your Business Insurance with Special Riders

Standard policies do a lot of heavy lifting for small businesses, but they aren’t always the whole story. A local independent insurance agency can review your overall business insurance program and help you decide which riders are worth considering, which ones you can skip, and how to keep coverage aligned with real-world risk instead of guesswork.

Standard Business Insurance May Not Be Enough

Most business owners policies package property coverage with general liability insurance in a way that works well for many small companies. But those policies are built on assumptions: typical buildings, typical contents, and typical operations. If your business leans on specialized equipment, stores data, relies heavily on utilities, or spends a lot of time off-site, you may need to look beyond the base policy.

The same is true for general liability insurance. It can respond to many everyday situations involving bodily injury or property damage to others, but it isn’t designed to handle every type of loss a modern business might face. Rather than buying a completely separate policy for every concern, some risks can be addressed with carefully chosen riders and endorsements.

Common Riders That Strengthen Coverage

Every carrier uses its own terminology, but in many programs, your independent agent might talk with you about common insurance riders such as:

Equipment breakdown coverage – Helps address covered losses if essential machinery, HVAC systems, or other equipment suddenly fails due to a covered breakdown, beyond standard wear and tear.

Utility services or off-premises power coverage – Can help when a covered utility outage away from your building causes a loss that affects your operations.

Outdoor signs and property riders – Offers broader protection for exterior signage, fences, or other outdoor items that might not be fully covered under basic property limits.

Hired and non-owned auto liability – Addresses certain liability situations when employees use personal or rented vehicles for business, which standard general liability insurance usually doesn’t cover.

Cyber or data-related endorsements – Adds limited protection for certain data breaches or cyber incidents that fall well outside traditional business owners insurance.

Ordinance or law coverage – Helps with extra costs required to bring damaged property up to current codes after a covered loss, when local rules have changed since the building was first constructed.

An Independent Agent Helps You Choose Riders

With so many options, it can be hard to know which riders are genuinely useful and which ones don’t match your situation. An independent insurance agency can start by mapping out the biggest what-ifs for your business: equipment failures, long power outages, off-site work, or customer data concerns. Then they can look at how your business owners insurance and general liability insurance respond today, and where a rider might fill in a meaningful gap.

Questions to ask your independent agent about riders

Before you add or remove any coverage, it’s helpful to ask clear, specific questions, such as:

Which parts of my current policy are most likely to leave a gap if we had a serious loss?

Are there riders that address those gaps more efficiently than buying a separate policy?

How would these riders work with my existing general liability insurance and BOP?

What would a typical claim look like with and without these riders in place?

If my business grows or changes, which riders are most likely to need adjusting first?

Disclaimer: This article is for general informational purposes only and is not legal, tax, or insurance advice.

6 Claim Scenarios for Business Owners & General Liability

When something goes wrong, most owners don’t think in policy language—they think in stories. A customer slips, a pipe bursts, or a fire shuts down operations. That’s when it helps to understand how business owners’ insurance and general liability insurance work together in real-world situations. A local independent insurance agency can walk you through your overall business insurance program using everyday examples, so it’s clearer which coverage is likely to respond when a claim happens.

Why Scenarios Help Clarify Coverage

General liability insurance focuses on injuries and damage you cause to others. Business owners’ insurance (often called a BOP) usually packages that liability protection with coverage for your building, equipment, and business personal property and can sometimes include business income coverage. Many small businesses carry these protections together, often inside the same policy.

Seeing how that plays out in real scenarios makes the coverage less abstract. Instead of guessing whether something is “property” or “liability,” you can picture how the policy might react to a specific event and talk with your agent about whether your limits and deductibles fit.

Six claim scenarios and how coverage may respond

Every claim is unique and subject to the terms of the policy, but these simple examples can help you frame better questions for your agent.

Customer slips and falls at your shop

A customer trips on a wet floor in your store and suffers an injury. They may look to your business for medical costs and other damages. This kind of third-party bodily injury is typically handled under general liability insurance, which is designed to respond when someone outside your business is hurt on your premises.Fire damages your building and inventory

An electrical issue sparks a fire after hours, damaging your building and destroying inventory and fixtures. In this scenario, it’s usually the property portion of your business owners’ policy that applies, helping address covered damage to your building and business personal property, subject to your limits and deductibles.Product you sell allegedly causes damage

A product you sold is blamed for damaging a customer’s property at their office. Claims involving damage caused by products you made or sold are often addressed under the products/completed operations portion of general liability insurance, if the loss is covered under your policy wording.Burst pipe forces you to close for several days

A pipe bursts over the weekend, damaging your stock and forcing a temporary closure while repairs are made. In many business owners’ policies, business income coverage (if included) can help replace lost income during a covered shutdown, while the property side may address the direct physical damage from the water.You accidentally damage a client’s property off-site

While working at a client’s location, an employee accidentally knocks over and breaks their equipment. Because the damage is to someone else’s property, away from your own premises, this type of loss is often handled under general liability insurance, assuming it falls within the scope of your covered operations.Windstorm damages your signage and outdoor property

A strong storm tears down your exterior sign and damages outdoor fixtures. If these items are scheduled and covered, the property coverage within your business owners policy may help pay to repair or replace them, up to the limits you selected.

How an independent agency helps you prepare for real claims

Scenarios like these are a starting point. The details of your operations, such as what you own, what you do, and where you work, shape how business owners’ insurance and general liability insurance should be set up for your company.

If you’d like to think through costs and coverage options before your next renewal, you can also read apractical guide to choosing business insurance without overpaying. Then, in a conversation with an agency such as the Hulett Insurance team, you can use your own real-world scenarios to decide how business owners and general liability coverage should work together for your business.

Disclaimer: This article is for general informational purposes only and is not legal, tax, or insurance advice.

Business Insurance Tips for Work-from-Home Owners

As more people work from home, it’s easy to assume your personal homeowners or renters policy will handle everything. But once money changes hands, you’re no longer just a resident—you’re running a business from your living room, spare bedroom, or garage. That’s where the right business insurance can help.

Why Home-Based Work Still Needs Business Insurance

From online shops and freelance design to bookkeeping and consulting, home-based work can create real financial risk. A client could get hurt visiting your home office, a package of products could be stolen, or a fire could damage inventory you’ve been storing in a spare room. In many cases, standard homeowners’ policies limit or exclude business-related property and liability.

That doesn’t mean you need a huge commercial policy for every side gig. It means you should be clear about what’s covered, what isn’t, and where a simple endorsement or small business policy could offer better protection.

Common Gaps for Work-from-Home Owners

Every home-based business is different, but a few common gaps emerge repeatedly when people turn a hobby or gig into a real income. During a review, your independent insurance agency will look closely at:

Business property kept at home, such as inventory, tools, or computer equipment used primarily for work.

Liability if clients or delivery drivers come to your home, including trips, falls, and other injuries tied to business activities.

Online sales and product shipments, especially if you ship physical items that could be damaged, lost, or cause harm.

Work done away from home, like client visits, local deliveries, or on-site services that may fall outside your basic homeowners policy.

Use of personal vehicles for business, including regular deliveries, client visits, or hauling equipment to job sites.

How an Independent Agency Helps You Choose Coverage

An independent insurance agency is not tied to one company’s products. Instead, they can compare options from several insurers and explain how each one would treat your home-based work. That might mean walking through a general liability insurance option for your services or finding a policy that bundles property and liability in a simple package.

They’ll also ask practical questions: how much income you earn from the gig, how often clients visit, how much equipment you own, and whether you store customer data or accept payments online. Those details help them match you with coverage that makes sense for your risk level and budget.

If you like to research ahead of time, you can review neutral resources such as the SBA’s guide to home-based businesses. Then you and your independent agent can use those ideas as a starting point for your own plan.

Questions to Ask Your Independent Insurance Agency

A short conversation can go a long way toward protecting the work you do at home. When you meet with an independent agent, consider asking:

How would my current homeowners or renters policy respond to business-related losses?

Do I need separate business insurance, or would an endorsement be enough?

How should I handle business property that leaves the house, like laptops or tools?

Does using my personal vehicle for deliveries or client visits change what I need?

If my home-based work grows, what coverage changes should I expect down the road?

Over time, those check-ins turn a casual gig into a more stable operation. You know which risks you’re taking, which ones are covered, and what steps to take if something goes wrong. With the right coverage, your home business will be ready to stand against the risks involved.

Disclaimer: This article is for general informational purposes only and is not legal, tax, or insurance advice.

5 Great Business Insurance Tweaks for New Year's

As the New Year rolls in, you’re probably thinking about budgets, goals, and taxes. It’s also the perfect time to give your business insurance a quick checkup. Over the past year, your operation may have changed more than you realize. A local independent insurance agency can help you review your overall business insurance program so your coverage matches the year ahead.

Even if you haven’t had a claim, quiet changes can slowly create gaps. Maybe you hired a few more people, added new equipment, or picked up a side service that wasn’t part of your original plan. Small adjustments now are often easier and less expensive than fixing problems after something goes wrong.

New Year is a Smart Time to Tweak Coverage

The New Year naturally encourages you to look back and look ahead. You’re already reviewing revenue, expenses, and forecasts. That makes it easier to talk through what actually changed: new customers, new locations, and any plans to grow.

An independent insurance agency starts with the bigger picture. They’ll ask about your space, staff, equipment, and services, then compare those details to what your current policies assume. If your business has outgrown its original setup, they can suggest focused tweaks rather than pushing a completely new policy.

Five Business Insurance Tweaks to Discuss

When you sit down with your independent insurance agent, a few topics tend to rise to the top. Ask about:

Property and equipment values – Have you bought new tools, technology, or inventory that should be reflected in your coverage amounts?

Liability limits and deductibles – Do your current limits and deductibles match your risk tolerance and cash flow today, not three years ago?

Business vehicles and drivers – Have you added or replaced vehicles, or changed who is allowed to drive for work purposes?

New services or operations – Did you start offering deliveries, on-site work, or other services that create different types of risk?

Key people and responsibilities – Have roles shifted in a way that might affect who needs to be listed or protected on your policies?

How an Independent Agency Fine-Tunes Protection

A New Year review isn’t about starting from scratch. It’s about making sure your existing coverage still fits. Your independent insurance agency can walk through your policies line by line, explain where your general liability insurance protection begins and ends, and highlight simple endorsements that might close important gaps.

They may also point you to neutral resources, such as an overview of small business insurance basics from the Insurance Information Institute. An outside perspective can make it easier to see how your own situation compares.

If you like to read up before your meeting, you might skim a practical guide to choosing business insurance without overpaying. Then, during your New Year review, you and your independent agent can talk through what’s changed in your operation, which of these five tweaks make sense, and how to keep your business insurance on track for the coming year..

Disclaimer: This article is for general informational purposes only and is not legal, tax, or insurance advice.

How an Independent Agency Supports Business Insurance Claims

When something goes wrong at your business, the claim usually arrives on top of an already stressful situation. You’re worried about repairs, staff, and customers, not policy language. That’s where a local independent insurance agency that understands your overall business insurance program makes a difference. A great independent agency knows how different policies respond to losses, what adjusters will ask for, and which details matter most.

Why Claims Support Matters

A claim is rarely “just paperwork.” It might involve damage to your building, stolen equipment, or a customer injury that affects your reputation and cash flow. In those moments, it’s easy to worry about saying the wrong thing or making decisions that might impact coverage.

Because an independent insurance agency works with multiple carriers, they can explain how your coverage is set up, where your deductibles and limits sit, and what your options look like before you authorize repairs or sign anything. Clear expectations up front make it easier to keep your business running while the claim is sorted out.

What an Independent Agency Does During Claims

During a claim, a strong independent agency acts as a guide and an advocate. Their job is to help you stay organized while the insurer evaluates what happened and how the policy responds. When a loss occurs, they can:

Help you report the claim promptly to the correct carrier and share key details.

Review your policy so you understand deductibles, limits, and major exclusions.

Suggest which documents to gather, like photos, inventory lists, and receipts.

Communicate with the adjuster to clarify how your business operates day to day.

Follow up on next steps so you know what to expect and when.

How Independent Agents Prepare You for a Claim

The best claims experience actually starts before there’s a loss. A proactive independent insurance agency will check in regularly about changes at your business like new locations, additional staff, updated equipment, or new services. During those reviews, they might suggest updates to your general liability insurance protection or highlight where a business owner’s policy could handle property and liability in one place.

In larger losses or disasters, a good agent may also remind you that options exist outside your policy—like SBA disaster assistance programs for small businesses—so you can explore every path for keeping the business moving while you recover.

Choose a Reputable Independent Insurance Agency

Not every agent takes the same approach to claims. When you’re evaluating a local independent insurance agency, look for a partner that offers ongoing reviews, clear communication, and real help if you ever have to file a claim. When you meet with a prospective agency, ask questions like:

How do you help business clients file and track a claim from start to finish?

Will I have a consistent point of contact if something goes wrong?

How often do you review coverage, limits, and exclusions with clients like me?

Can you share examples of how you’ve helped other local businesses through a claim?

Over time, that kind of relationship means you’re not just buying a policy from a website. You’re working with an independent insurance agency that can help you choose coverage, support you during a business insurance claim, and adjust your protection as your company grows. If you want to prepare before your next renewal, you might skim this practical guide to choosing business insurance without overpaying so you can ask better questions.

Disclaimer: This article is for general informational purposes only and is not legal, tax, or insurance advice.

Why General Liability Insurance Is Essential for Customer-Facing Businesses

Any business that interacts directly with customers carries unique risks. From foot traffic in storefronts to service visits at client locations, general liability insurance plays a critical role in protecting against unexpected incidents. This type of coverage helps safeguard customer-facing companies from legal and financial exposure that can arise during everyday operations.

Customer Interactions Increase Exposure to Accidents

When customers enter your business or you send staff to theirs, the chance of accidents increases. According to the National Safety Council, slip-and-fall incidents remain one of the most common sources of third-party injury claims for small businesses.

Social environments, foot traffic patterns, and physical layout all influence your exposure level. Customer-facing businesses rely on general liability insurance because it helps manage the unpredictable nature of human interaction.

Damage to Customer Property Is a Real Concern

Service providers, repair companies, contractors, and consultants often work inside customer homes or offices. Accidental damage to property can occur even with careful procedures. When businesses fail to protect their business against external claims, they risk huge expenses that could threaten the company’s future

Advertising and Personal Injury Risks

Customer-facing companies also interact with the public through advertising, online content, and social communication. General liability insurance can help address claims related to personal injury, including libel or copyright issues, depending on policy details.

Industry Requirements and Vendor Contracts

In many industries, vendors or landlords require proof of general liability insurance before allowing businesses to operate in shared spaces. Event venues, retail leases, and service contracts commonly list minimum liability limits as part of onboarding requirements. It is a good idea to review your coverages before major events or expanding into new operations.

Why these requirements exist

Businesses must demonstrate adequate protection

Liability limits align with shared-space risks

Contract compliance reduces conflict

Vendors may refuse to work with uninsured businesses

Proof of insurance builds trust

How Customer-Facing Businesses Can Reduce Liability Risk

While sufficient coverage is vital, there is a lot that you can do to minimize the risks ahead of time. These steps do not eliminate your liability, but they will reduce common hazards that often result in claims being filed against you.

Maintain organized, accessible walkways

Train employees on customer safety procedures

Document service steps and incident responses

Use signage for hazards or wet floors

Review liability limits annually as traffic grows

Short FAQ

Q: Do all customer-facing businesses need general liability insurance?

A: Yes, because exposure to visitor accidents and property damage exists in nearly every customer interaction.

Q: Does GL insurance cover employee injuries?

A: No. Employee injuries are handled under workers’ compensation insurance.

Q: Can GL insurance help with reputation-related claims?

A: Some policies include coverage for advertising or personal injury claims.

Disclaimer: This content is for informational purposes only and is not intended as legal or insurance advice.

Why Local Businesses Need Both Business Owners Insurance and General Liability Insurance

Local businesses face a mix of physical, financial, and legal risks that no single policy can fully address. While business owners insurance and general liability insurance are sometimes discussed together, they serve distinct functions. Understanding why both are important helps ensure your business remains protected against common exposures.

Business Owners Insurance Protects Your Physical Assets

Business owners insurance (often called a BOP) combines property coverage, liability protection, and business interruption into one policy. This structure helps businesses safeguard buildings, equipment, inventory, and operational income. For example, a fallen tree may impact your ability to function, but should not result in catastrophic losses.

General Liability Covers Third-Party Injury and Damage

General liability insurance focuses on legal claims that arise from everyday business activities. It helps cover bodily injury, property damage, and certain advertising injury situations that can occur during normal operations. The Federal Trade Commission provides a helpful explanation of how liability exposures arise through customer interactions and service activities.

Why Both Policies Matter

Carrying both policies ensures protection from internal and external risks. Business owners insurance shields your own property and income, while general liability covers claims brought by customers, vendors, or visitors. Business insurance should also include the possibility that your company may suffer from losses related to losses that are beyond control. Together, they address the two sides of risk: damage to your business and claims made against it.

Combined benefits

Protection for buildings and equipment

Coverage for third-party injuries

Support during business interruptions

Flexibility to add endorsements for specific industries

Broader alignment with vendor and lease requirements

Real-World Examples for Local Companies

A retail shop in Southlake might rely on a BOP to protect inventory from fire damage, while general liability helps cover injuries if a customer slips inside the store. A service contractor in Fort Worth may use general liability to address client-site accidents but still need a BOP for equipment protection in storage or transit. Operational variations are why many companies benefit from both policies simultaneously.

How to Evaluate Your Coverage Needs

Every company faces unique risks. Startups are focused on growth during the early years, for example, while established businesses need to protect what they have built. Here are a few examples of areas where business needs may vary a great deal:

Identify physical assets your business owns or leases

Review customer interaction levels and exposure to visitor injury

Consider business interruption risks

Check contract requirements from vendors or landlords

Review existing endorsements for accuracy and relevance

Key Takeaways

Business owners insurance protects physical assets and income.

General liability focuses on third-party injury and damage claims.

Most local businesses benefit from carrying both types of coverage.

Using both policies creates a more complete risk management strategy.

Coverage needs should be reviewed regularly as operations evolve.

Disclaimer: This content is for informational purposes only and is not intended as legal or insurance advice.

The Key Differences Between Business Owners Insurance and General Liability Insurance

Many business owners comparing business owners insurance and general liability insurance find the terms confusing — yet the differences are meaningful. Each type serves a distinct role in business risk management. Understanding those roles helps align coverage with real operational needs rather than buying protection based on terminology alone.

What Business Owners Insurance Covers

Business owners insurance (often called a BOP) is designed for smaller businesses that want a bundled solution combining property, liability, and interruption coverage. BOP packages typically cover property damage, equipment loss, and business interruption in one streamlined offering. Since the details vary both at the insurer level and the individual business needs, consulting with a reputable insurance agent is the best course of action.

What General Liability Insurance Covers

General liability insurance is more narrowly focused: it protects against third-party claims for bodily injury, property damage, and advertising or personal injury stemming from your business operations. Depending on your business operations, adding professional liability may provide protection that general liability policies ignore.

Key Differences Explained

A summary by IRMI reinforces that general liability focuses on external legal exposures, while broader business policies cover additional operational risks. To help clarify, here are comparison points to keep in mind:

Which Fits Your Business Better?

Choosing the right coverage depends on your business structure. For example, cybercrime and liability are important aspects of business insurance that are often overlooked. Other considerations include:

If you own or lease commercial space, invest in equipment, or face business interruption risk, a BOP likely offers more targeted protection.

If your operations are service-based, have low physical assets, and focus primarily on third-party exposures, GL might suffice.

Short FAQ

Q: Can I purchase both business owners insurance and general liability insurance?

A: Yes. In some cases a business may layer coverage where necessary.

Q: Does a BOP always replace general liability insurance?

A: No. Although a BOP includes liability, GL alone does not cover property or income risk.

Q: Is general liability enough if I have no property assets?

A: Possibly—but it’s wise to review your exposure, especially with vendor contracts and service-based risks.

Key Takeaways

Business owners insurance bundles property, liability, and income protection; general liability focuses on third-party legal exposures.

A BOP may offer more comprehensive coverage for businesses with physical assets.

GL insurance remains essential for liability but does not protect your own property or income.

The right choice depends on your asset base, operational risks, and business profile.

Work with your independent agency to evaluate which option aligns best with your current business structure.

Disclaimer: This content is for informational purposes only and is not intended as legal or insurance advice.

Why Independent Insurance Agents Are a Better Fit for Local Businesses

Local businesses need insurance support that adapts to changing operations, staffing, and growth. An independent insurance agency offers this advantage by aligning coverage with local and regional conditions in to address unique considerations. This flexible model helps business owners keep protection relevant over time.

Independent Agents Offer Broader Market Access

Unlike captive agents, independent agents can gather quotes from multiple insurers. This allows them to compare terms, endorsements, and premium structures on behalf of the business owner. Access to several carriers also makes it easier to adjust coverage during renewals.

Local Knowledge Supports More Accurate Coverage

Independent agents understand the specific risks that affect local businesses, from regional weather patterns to industry trends. Their familiarity with the community allows them to tailor coverage more effectively. This can be especially important in rural areas that face logistics and supply constraints.

Why local insight matters

Awareness of seasonal risks

Understanding local building requirements

Familiarity with common claim types

Knowledge of regional business growth patterns

Ability to identify gaps based on local regulations

Adaptability as Business Conditions Change

Commercial operations rarely stay static. New equipment, expanded services, or additional employees can change risk levels. Independent agents can quickly reassess coverage with other carriers when these shifts occur. For reference on managing workplace risks, explore guidance from OSHA.

Independent Agents Simplify Policy Reviews

Regular policy reviews help ensure that commercial coverage matches the business’s current needs. Independent agents make this process easier by checking multiple insurers for updated terms or better-aligned options. Where a captive agent is only able to offer coverages from a single insurance carrier, your independent agent can choose among carriers to find you the best rates and coverage.

Support Throughout the Insurance Cycle

Many independent agents provide ongoing support during claims, renewals, and documentation updates. This continuity makes it easier for small businesses to stay organized and prevent gaps. This may sound counterintuitive, but your local insurance agent can orchestrate excellent coverage and lower premiums at the same time.

Mini-guide for better insurance decisions

Keep updated records of business property

Document staff changes each year

Compare policy exclusions during renewals

Record major purchases for property updates

Track changes in services or equipment

Short FAQ

Q: Do independent agents work with small or large businesses

A: They work with both, but their flexibility is especially useful for small to mid-sized businesses.

Q: Can independent agents help with specialty policies

A: Yes. Their carrier network often includes insurers that write niche or unusual risks.

Q: Does working with an independent agent limit my carrier choices

A: No. It typically expands them.

Key Takeaways

Independent agents offer access to multiple carriers, giving local businesses more choices.

Regional knowledge helps tailor coverage to Southlake and surrounding communities.

Policy reviews become more effective with broader market access.

Changing business conditions are easier to manage through flexible carrier options.

Long-term support helps simplify insurance decisions for busy business owners.

Disclaimer: This content is for informational purposes only and is not intended as legal or insurance advice.

How to Prepare for a Business Insurance Policy Review

A business insurance policy review helps ensure your coverage still matches your operations, assets, and risks. For many business owners, an independent insurance agency provides the flexibility needed to adjust policies as the company grows. A smooth review starts with good preparation, clear records, and updated business details.

Understand Why Reviews Matter

Business conditions rarely stay the same. New hires, equipment, expansions, and changing liabilities all influence what your insurance should cover. A review prevents outdated limits or missing endorsements from creating financial gaps. A helpful overview of business insurance fundamentals can be found at the Small Business Administration.

Gather Updated Business Information

Before your review, make sure basic operational details are accurate. Even small changes can affect risk levels. If your company has added new services or adjusted how work is performed, those updates should be reflected in your insurance coverage.

Key items to prepare

Annual revenue figures

Number of employees

List of owned or leased equipment

Vehicle details if applicable

Property or office location changes

Review Current Policies Line by Line

A thorough evaluation begins with examining what you already have. Compare each policy section to your current operations. Liability limits, deductibles, and endorsements should align with the actual exposures your business faces.

Document Changes to Assets and Property

Any changes in equipment, inventory, or location should be addressed by your independent insurance agent. These details help determine accurate commercial property and liability protection. What this boils down to is that you don’t want to continue paying for something that has become obsolete, but should protect new items in your business operations.

Helpful mini-guide

Keep receipts or invoices for major purchases

Update the age and condition of equipment

Record serial numbers for high-value assets

Document security upgrades or building improvements

Note changes in storage or transportation methods

Prepare Questions for Your Independent Agent

A review is more productive when you understand what to ask. Independent agencies can compare coverage options across multiple carriers, so clear questions help tailor the discussion. Preparing for a business insurance overview may require you to do a little research before getting started, such as reading up on ways to achieve superior coverage without overpaying.

Questions to consider

Do my current limits match my business size

Are there new risks I should insure

Should I adjust deductibles

Are there coverage overlaps

Have carrier requirements changed

Short FAQ

Q: How often should a business review its insurance policies

A: Once a year is recommended, but major changes may require midyear reviews.

Q: Should I bring financial documents

A: Yes. Accurate revenue and payroll figures help determine proper coverage.

Q: Do equipment upgrades affect insurance

A: Yes. Updated assets should be recorded to match property and liability needs.

Key Takeaways

A policy review protects your business from outdated or insufficient coverage.

Organized records help your independent agent match policies to real operations.

Updated asset details lead to more accurate recommendations.

Clear questions make the review process more efficient and productive.

Regular evaluations help coverage stay aligned with growth and changing risks.

Disclaimer: This content is for informational purposes only and is not intended as legal or insurance advice.

What Makes Independent Insurance Agencies More Flexible for Business Owners

Business owners often need coverage that adapts to growth, seasonal changes, shifting risks, and long-term planning. An independent insurance agency provides this flexibility by offering more carriers, more choices, and more tailored guidance than single-carrier companies. This adaptable model supports business owners in Southlake and across Texas who want options that align with real-world operational changes.

Independent Agencies Work With Multiple Carriers

Instead of relying on one insurer, independent agencies partner with numerous carriers, allowing businesses to compare coverage, pricing, and underwriting differences in one place. When market conditions change, the agency can realign options without forcing the business owner to restart the shopping process.

2. Policies Can Adjust to Business Growth

As a business adds employees, equipment, vehicles, or locations, insurance needs evolve. Independent insurance agencies can adapt policies quickly because they are not locked into one carrier’s structure. This helps owners maintain appropriate business protection during expansion or operational changes.

3. Local Insight Strengthens Coverage Decisions

Local agencies understand regional risks such as severe weather, population growth, and industry patterns that affect small and mid-size businesses. This regional awareness helps create more practical coverage recommendations. For a broader look at risk factors that influence commercial insurance, review these findings from the National Safety Council.

4. Clear Guidance for Complex Coverage Types

Business owners often face confusing coverage decisions involving liability, commercial property, professional exposures, and cyber-related risks. Independent agencies break down these details and help owners compare policy structures from different carriers.

Helpful mini-guides for business owners

Review policy limits annually to reflect asset changes

Map insurance needs to current operations

Track renewal timing to avoid unintentional coverage gaps

Keep an updated list of high-value equipment

Identify new exposures created by digital tools or remote work

5. Easier Bundling Across Carrier Options

Bundling coverage can improve consistency and reduce administrative complexity. Independent agencies can compare bundled packages from multiple carriers, giving business owners more flexibility to align benefits and pricing with daily operations.

What Business Owners Should Evaluate

A flexible insurance strategy depends on understanding how operations shift throughout the year. Independent agencies help identify potential weak points before they become costly problems.

Key evaluation areas include:

Staff additions or role changes

Equipment upgrades or new vehicles

Multi-location expansions

New digital tools or online sales channels

Updated vendor or client requirements

Short FAQ for Business Owners

Q: Do independent agencies cost more?

A: No. Their value comes from broader access to carriers and tailored guidance.

Q: Can they help with unusual or specialized risks?

A: Yes. Multiple carriers allow more options for unique exposures.

Q: Is support available during claims?

A: Many independent agencies assist clients through each step of the process.

Key Takeaways

Independent insurance agencies offer flexibility by working with multiple carriers.

They adjust coverage as businesses grow or change.

Local insight and advisory support help owners avoid coverage gaps.

Bundling becomes easier when multiple carriers are available.

Regular evaluation ensures business protection stays aligned with real operational needs.

Disclaimer: This content is for informational purposes only and is not intended as legal or insurance advice.

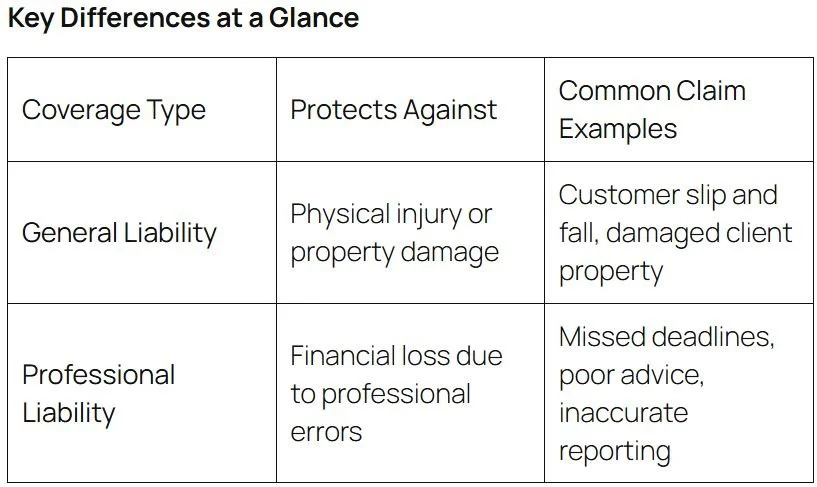

General Liability vs. Professional Liability: What’s the Difference?

Many business owners assume that one insurance policy can cover every type of risk—but that’s rarely true. Understanding the difference between general liability insurance and professional liability coverage is essential for ensuring your company is protected on all fronts. Together, they form a powerful foundation within your business owners insurance strategy.

General Liability: Coverage for Everyday Risks

General liability insurance protects your business from third-party claims involving bodily injury, property damage, or personal harm caused by your operations. For example, if a client slips on your office floor or a contractor accidentally damages a customer’s property, this policy pays for legal defense, settlements, and medical costs.

It’s the first line of defense for most businesses because it addresses physical and situational risks that can happen during daily operations. General liability is typically included in a Business Owners Policy (BOP), offering broad protection for common incidents that could otherwise disrupt cash flow or reputation.

Professional Liability: Coverage for Errors and Omissions

Professional liability, also known as errors and omissions (E&O) insurance, covers claims related to professional mistakes, negligence, or failure to deliver promised results. This coverage applies to businesses that provide specialized expertise—consultants, architects, accountants, and service providers of all kinds.

If a client claims your advice or work caused financial loss, professional liability insurance covers the cost of defending your business and paying any judgments or settlements. It focuses on your performance and decision-making rather than physical accidents.

Why Both Types May Be Necessary

It’s common for growing businesses to assume they only need one type of policy. However, general and professional liability cover entirely different risk categories. A marketing firm, for instance, could face a slip-and-fall injury at its office (general liability) and a lawsuit over a failed advertising campaign (professional liability). Without both, significant coverage gaps remain.

Bundling these coverages under a business owners insurance policy can simplify administration and sometimes reduce total premiums. Your agent can tailor a plan that fits your profession and exposure level, ensuring each policy complements the other.

How to Choose the Right Balance

Evaluating your risk profile with an experienced independent agent helps determine where your greatest exposures lie. If you provide consulting or technical services, professional liability is likely essential. For companies interacting frequently with customers or the public, general liability is nonnegotiable. Many businesses need both, tailored with the right limits and deductibles.

The bottom line: each coverage plays a unique role in keeping your company secure. Together, they ensure that one unexpected event—whether a lawsuit or a simple accident—doesn’t jeopardize years of work.

What Business Owners Should Know About Claims & Legal Defense Costs

Even the most careful business owners face the possibility of lawsuits. A single claim, whether it involves a customer injury, property damage, or contract dispute, can quickly lead to expensive legal fees. Knowing how business owners’ insurance and general liability insurance respond to these situations helps you plan to avoid financial surprises.

Understanding the Basics of Liability Coverage

General liability insurance protects your company when someone claims bodily injury, property damage, or personal harm resulting from your operations. It typically covers both settlements and the legal defense costs needed to resolve the case. Defense costs include attorney fees, court expenses, expert witnesses, and administrative costs related to the claim.

For most policies, these defense expenses are paid in addition to your coverage limits. That means if your policy limit is $1 million, and your defense costs reach $100,000, your insurer covers both—unless the policy states otherwise. Always confirm this detail during renewal so you know exactly how much protection your business has.

When Business Owners’ Insurance Adds Extra Protection

A business owners insurance policy combines general liability with property and business interruption coverage, creating a streamlined solution for small and midsize businesses. While liability coverage handles lawsuits, the property portion protects your physical assets, and the business interruption section replaces lost income during downtime.

This bundled structure often simplifies claims handling. When a single event triggers multiple losses—such as a fire that damages property and causes injury—your carrier coordinates all aspects of the claim through one process, saving time and reducing administrative headaches.

The Rising Cost of Legal Defense

Litigation costs have climbed sharply in recent years, even for minor disputes. Attorney rates, expert analysis, and discovery costs all add up quickly. Without the right coverage, small businesses can spend tens of thousands defending a claim, even if they ultimately win.

Comprehensive general liability insurance ensures that these costs don’t come directly out of your operating budget. Some policies also include coverage for pre-litigation investigations and arbitration; important benefits that can reduce total exposure before a case reaches court.

Managing Claims Effectively

The best time to think about claims is before they happen. Establishing clear internal procedures helps prevent errors that could jeopardize coverage. Assign someone in your organization to manage incident documentation, communicate with your insurer, and coordinate with legal counsel as needed.

Timely reporting is essential. Most policies require prompt notice of potential claims, even if no lawsuit has been filed yet. Waiting too long can complicate coverage eligibility or reduce available benefits.

Partnering With the Right Agency

An experienced agent helps ensure your coverage reflects today’s legal realities. By reviewing past claim trends and industry benchmarks, your advisor can recommend higher limits, umbrella protection, or endorsements that extend defense coverage. Working with a proactive professional means your policy will adapt before legal costs outpace your protection.

Understanding how legal expenses are handled is critical to building a sustainable risk management plan. The right combination of business owners and general liability coverage can turn unexpected claims into manageable challenges instead of financial crises.