6 Claim Scenarios for Business Owners & General Liability

When something goes wrong, most owners don’t think in policy language—they think in stories. A customer slips, a pipe bursts, or a fire shuts down operations. That’s when it helps to understand how business owners’ insurance and general liability insurance work together in real-world situations. A local independent insurance agency can walk you through your overall business insurance program using everyday examples, so it’s clearer which coverage is likely to respond when a claim happens.

Why Scenarios Help Clarify Coverage

General liability insurance focuses on injuries and damage you cause to others. Business owners’ insurance (often called a BOP) usually packages that liability protection with coverage for your building, equipment, and business personal property and can sometimes include business income coverage. Many small businesses carry these protections together, often inside the same policy.

Seeing how that plays out in real scenarios makes the coverage less abstract. Instead of guessing whether something is “property” or “liability,” you can picture how the policy might react to a specific event and talk with your agent about whether your limits and deductibles fit.

Six claim scenarios and how coverage may respond

Every claim is unique and subject to the terms of the policy, but these simple examples can help you frame better questions for your agent.

Customer slips and falls at your shop

A customer trips on a wet floor in your store and suffers an injury. They may look to your business for medical costs and other damages. This kind of third-party bodily injury is typically handled under general liability insurance, which is designed to respond when someone outside your business is hurt on your premises.Fire damages your building and inventory

An electrical issue sparks a fire after hours, damaging your building and destroying inventory and fixtures. In this scenario, it’s usually the property portion of your business owners’ policy that applies, helping address covered damage to your building and business personal property, subject to your limits and deductibles.Product you sell allegedly causes damage

A product you sold is blamed for damaging a customer’s property at their office. Claims involving damage caused by products you made or sold are often addressed under the products/completed operations portion of general liability insurance, if the loss is covered under your policy wording.Burst pipe forces you to close for several days

A pipe bursts over the weekend, damaging your stock and forcing a temporary closure while repairs are made. In many business owners’ policies, business income coverage (if included) can help replace lost income during a covered shutdown, while the property side may address the direct physical damage from the water.You accidentally damage a client’s property off-site

While working at a client’s location, an employee accidentally knocks over and breaks their equipment. Because the damage is to someone else’s property, away from your own premises, this type of loss is often handled under general liability insurance, assuming it falls within the scope of your covered operations.Windstorm damages your signage and outdoor property

A strong storm tears down your exterior sign and damages outdoor fixtures. If these items are scheduled and covered, the property coverage within your business owners policy may help pay to repair or replace them, up to the limits you selected.

How an independent agency helps you prepare for real claims

Scenarios like these are a starting point. The details of your operations, such as what you own, what you do, and where you work, shape how business owners’ insurance and general liability insurance should be set up for your company.

If you’d like to think through costs and coverage options before your next renewal, you can also read apractical guide to choosing business insurance without overpaying. Then, in a conversation with an agency such as the Hulett Insurance team, you can use your own real-world scenarios to decide how business owners and general liability coverage should work together for your business.

Disclaimer: This article is for general informational purposes only and is not legal, tax, or insurance advice.

Why General Liability Insurance Is Essential for Customer-Facing Businesses

Any business that interacts directly with customers carries unique risks. From foot traffic in storefronts to service visits at client locations, general liability insurance plays a critical role in protecting against unexpected incidents. This type of coverage helps safeguard customer-facing companies from legal and financial exposure that can arise during everyday operations.

Customer Interactions Increase Exposure to Accidents

When customers enter your business or you send staff to theirs, the chance of accidents increases. According to the National Safety Council, slip-and-fall incidents remain one of the most common sources of third-party injury claims for small businesses.

Social environments, foot traffic patterns, and physical layout all influence your exposure level. Customer-facing businesses rely on general liability insurance because it helps manage the unpredictable nature of human interaction.

Damage to Customer Property Is a Real Concern

Service providers, repair companies, contractors, and consultants often work inside customer homes or offices. Accidental damage to property can occur even with careful procedures. When businesses fail to protect their business against external claims, they risk huge expenses that could threaten the company’s future

Advertising and Personal Injury Risks

Customer-facing companies also interact with the public through advertising, online content, and social communication. General liability insurance can help address claims related to personal injury, including libel or copyright issues, depending on policy details.

Industry Requirements and Vendor Contracts

In many industries, vendors or landlords require proof of general liability insurance before allowing businesses to operate in shared spaces. Event venues, retail leases, and service contracts commonly list minimum liability limits as part of onboarding requirements. It is a good idea to review your coverages before major events or expanding into new operations.

Why these requirements exist

Businesses must demonstrate adequate protection

Liability limits align with shared-space risks

Contract compliance reduces conflict

Vendors may refuse to work with uninsured businesses

Proof of insurance builds trust

How Customer-Facing Businesses Can Reduce Liability Risk

While sufficient coverage is vital, there is a lot that you can do to minimize the risks ahead of time. These steps do not eliminate your liability, but they will reduce common hazards that often result in claims being filed against you.

Maintain organized, accessible walkways

Train employees on customer safety procedures

Document service steps and incident responses

Use signage for hazards or wet floors

Review liability limits annually as traffic grows

Short FAQ

Q: Do all customer-facing businesses need general liability insurance?

A: Yes, because exposure to visitor accidents and property damage exists in nearly every customer interaction.

Q: Does GL insurance cover employee injuries?

A: No. Employee injuries are handled under workers’ compensation insurance.

Q: Can GL insurance help with reputation-related claims?

A: Some policies include coverage for advertising or personal injury claims.

Disclaimer: This content is for informational purposes only and is not intended as legal or insurance advice.

The Key Differences Between Business Owners Insurance and General Liability Insurance

Many business owners comparing business owners insurance and general liability insurance find the terms confusing — yet the differences are meaningful. Each type serves a distinct role in business risk management. Understanding those roles helps align coverage with real operational needs rather than buying protection based on terminology alone.

What Business Owners Insurance Covers

Business owners insurance (often called a BOP) is designed for smaller businesses that want a bundled solution combining property, liability, and interruption coverage. BOP packages typically cover property damage, equipment loss, and business interruption in one streamlined offering. Since the details vary both at the insurer level and the individual business needs, consulting with a reputable insurance agent is the best course of action.

What General Liability Insurance Covers

General liability insurance is more narrowly focused: it protects against third-party claims for bodily injury, property damage, and advertising or personal injury stemming from your business operations. Depending on your business operations, adding professional liability may provide protection that general liability policies ignore.

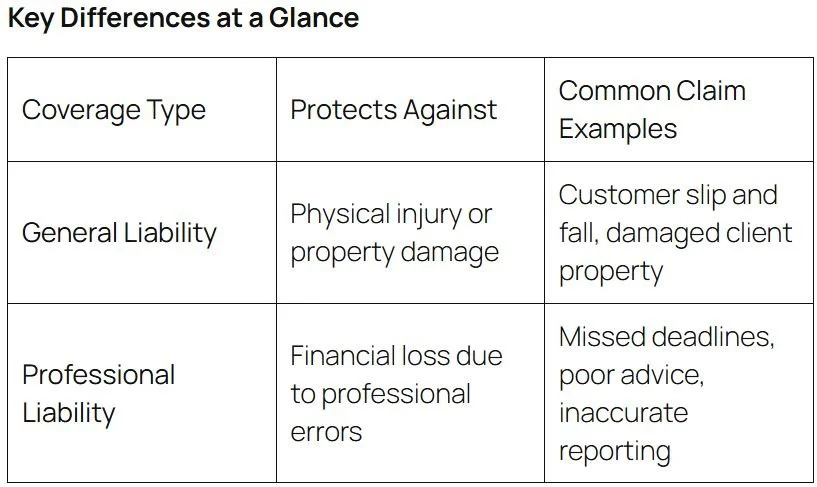

Key Differences Explained

A summary by IRMI reinforces that general liability focuses on external legal exposures, while broader business policies cover additional operational risks. To help clarify, here are comparison points to keep in mind:

Which Fits Your Business Better?

Choosing the right coverage depends on your business structure. For example, cybercrime and liability are important aspects of business insurance that are often overlooked. Other considerations include:

If you own or lease commercial space, invest in equipment, or face business interruption risk, a BOP likely offers more targeted protection.

If your operations are service-based, have low physical assets, and focus primarily on third-party exposures, GL might suffice.

Short FAQ

Q: Can I purchase both business owners insurance and general liability insurance?

A: Yes. In some cases a business may layer coverage where necessary.

Q: Does a BOP always replace general liability insurance?

A: No. Although a BOP includes liability, GL alone does not cover property or income risk.

Q: Is general liability enough if I have no property assets?

A: Possibly—but it’s wise to review your exposure, especially with vendor contracts and service-based risks.

Key Takeaways

Business owners insurance bundles property, liability, and income protection; general liability focuses on third-party legal exposures.

A BOP may offer more comprehensive coverage for businesses with physical assets.

GL insurance remains essential for liability but does not protect your own property or income.

The right choice depends on your asset base, operational risks, and business profile.

Work with your independent agency to evaluate which option aligns best with your current business structure.

Disclaimer: This content is for informational purposes only and is not intended as legal or insurance advice.

General Liability vs. Professional Liability: What’s the Difference?

Many business owners assume that one insurance policy can cover every type of risk—but that’s rarely true. Understanding the difference between general liability insurance and professional liability coverage is essential for ensuring your company is protected on all fronts. Together, they form a powerful foundation within your business owners insurance strategy.

General Liability: Coverage for Everyday Risks

General liability insurance protects your business from third-party claims involving bodily injury, property damage, or personal harm caused by your operations. For example, if a client slips on your office floor or a contractor accidentally damages a customer’s property, this policy pays for legal defense, settlements, and medical costs.

It’s the first line of defense for most businesses because it addresses physical and situational risks that can happen during daily operations. General liability is typically included in a Business Owners Policy (BOP), offering broad protection for common incidents that could otherwise disrupt cash flow or reputation.

Professional Liability: Coverage for Errors and Omissions

Professional liability, also known as errors and omissions (E&O) insurance, covers claims related to professional mistakes, negligence, or failure to deliver promised results. This coverage applies to businesses that provide specialized expertise—consultants, architects, accountants, and service providers of all kinds.

If a client claims your advice or work caused financial loss, professional liability insurance covers the cost of defending your business and paying any judgments or settlements. It focuses on your performance and decision-making rather than physical accidents.

Why Both Types May Be Necessary

It’s common for growing businesses to assume they only need one type of policy. However, general and professional liability cover entirely different risk categories. A marketing firm, for instance, could face a slip-and-fall injury at its office (general liability) and a lawsuit over a failed advertising campaign (professional liability). Without both, significant coverage gaps remain.

Bundling these coverages under a business owners insurance policy can simplify administration and sometimes reduce total premiums. Your agent can tailor a plan that fits your profession and exposure level, ensuring each policy complements the other.

How to Choose the Right Balance

Evaluating your risk profile with an experienced independent agent helps determine where your greatest exposures lie. If you provide consulting or technical services, professional liability is likely essential. For companies interacting frequently with customers or the public, general liability is nonnegotiable. Many businesses need both, tailored with the right limits and deductibles.

The bottom line: each coverage plays a unique role in keeping your company secure. Together, they ensure that one unexpected event—whether a lawsuit or a simple accident—doesn’t jeopardize years of work.

4 Cyber Threat Insurance Tips That Businesses Love

Cybersecurity isn’t just a big-company issue. Small and mid-sized businesses are increasingly targeted by phishing, ransomware, and vendor-related breaches that can disrupt operations and strain cash flow. That’s why it’s smart to combine strong defenses with the right business owners insurance. Cyber liability coverage is most effective when it’s part of a broader risk plan.

Understand What Cyber Insurance Covers

Cyber insurance policies commonly address first-party costs (forensic investigation, data restoration, breach notification, crisis management) and third-party liability (regulatory actions, privacy lawsuits, and contractual claims). Read exclusions carefully because social engineering, voluntary transfers, and vendor-caused incidents are often limited or require endorsements. Align limits and sublimit with your real exposure (records held, downtime risk, and dependency on key vendors).

Pair Insurance With Robust Security Measures

Insurers increasingly expect baseline controls: MFA on email and remote access, endpoint protection, encrypted backups with offline copies, and staff phishing training. These reduce loss frequency and can improve insurability. A layered approach strengthens claims positions and may lower premiums over time. Round out your program with strong general liability insurance for non-cyber third-party risks.

Tailor Policies to Industry Risk

Threats vary by sector. Retailers worry about payment data; healthcare and professional firms face privacy and confidentiality exposures; manufacturers and logistics depend on operational tech and supplier networks. Choose forms that match your profile (PCI exposure, PHI/PII volumes, critical vendors) and verify business-interruption triggers. For an independent overview of coverage types and limitations, see Cyber insurance: a key part of a robust business strategy.

Have a Clear Incident Response Plan

Speed matters. Document who to call (IT, legal, forensics, carrier hotline), how to isolate systems, and what to tell customers and partners. Practice tabletop drills so roles and thresholds are clear. Keep vendor contracts and an asset inventory handy to accelerate containment and notification. Update your plan after each drill or near-miss.

Additional Insight: Leverage Insurance as a Strategic Asset

Many policies include complimentary services—risk assessments, training modules, vulnerability scans, even incident coaches. Use them to harden controls and justify higher limits as you grow. For a business-wide perspective that includes cyber, read Business Insurance Coverages You Can’t Afford to Ignore.

Cyber Insurance FAQ

Q: Do all businesses need cyber insurance?

A: If you store customer data, process payments, or rely on cloud tools, yes—your operations carry cyber risk that insurance can help transfer.

Q: Is cyber coverage expensive for small businesses?

A: Pricing depends on controls, industry, and limits, but many small firms find entry-level coverage affordable, especially when packaged with other policies.

Q: What factors influence the cost of cyber insurance?

A: Carriers evaluate company size, industry, claims history, and security measures in place. Strong cybersecurity controls often lead to lower premiums.

Q: How quickly can a cyber insurance policy respond after a breach?

A: Many policies provide access to 24/7 response teams, allowing businesses to engage forensic experts, legal counsel, and notification services immediately.

Protect cash flow, reassure customers, and keep the business running. Your independent issuance agent can help you combine comprehensive coverage with prevention and a tested response plan.

6 Most Important Contractor Insurance Options You'll Want

Contractors face unique risks on every project site. From accidents involving workers to property damage and liability claims, one incident can lead to costly setbacks. That’s why the right business insurance coverage is a foundation for any contracting business. What policies do contractors consistently rely on to protect their operations and reputation? Explore business insurance coverage in Southlake for details.

General Liability Insurance

This policy is considered essential for contractors. It covers third-party injuries, property damage, and legal expenses. Imagine a client’s property being damaged during a remodel. Without general liability coverage, the contractor would pay out of pocket, risking both profits and reputation.

Workers’ Compensation Insurance

Construction work carries a high risk of injury. Workers’ compensation insurance covers medical expenses and lost wages for employees hurt on the job. Beyond protecting staff, it shields contractors from lawsuits that can follow workplace accidents.

Commercial Auto Insurance

Contractors often depend on fleets of trucks, vans, or trailers. Commercial auto insurance protects vehicles, drivers, and transported materials. Whether it’s a collision on the highway or theft of tools from a company van, this coverage ensures contractors can continue working without major financial setbacks. The U.S. Small Business Administration offers insights on commercial auto policies.

Professional Liability Insurance

Also known as errors and omissions insurance, this coverage addresses claims that work was incomplete, delayed, or substandard. For example, if a project fails inspection due to a contractor’s oversight, professional liability insurance helps cover costs and legal defense.

Builder’s Risk Insurance

Contractors managing new construction projects often purchase builder’s risk insurance. It covers structures in progress as well as equipment and materials on-site. Fires, theft, or vandalism can quickly derail projects, but builder’s risk coverage helps keep timelines intact.

Umbrella Liability Insurance

When claims exceed the limits of standard policies, umbrella liability steps in. Contractors working on large-scale projects particularly value this coverage, as it provides an extra layer of financial security.

Additional Tips for Contractors

Review policies annually to ensure they match current project sizes.

Combine coverages through bundled packages to save costs.

Ask insurers about safety program discounts.

Keep detailed documentation to simplify claim approvals.

Benefits of Working with an Independent Insurance Agent

Independent insurance agents help contractors cut through the complexity of multiple policies. Unlike agents tied to a single carrier, they compare options across several providers to find coverage that fits both budget and risk profile. This approach ensures contractors are not overpaying for unnecessary policies while still closing gaps in protection. A qualified agent also provides ongoing guidance, adjusting coverage as projects grow or new risks emerge.

FAQ

Q: Is builder’s risk insurance required for every project?

A: Not always, but lenders and clients frequently require it for large-scale construction.

Q: How much umbrella liability coverage should contractors carry?

A: It depends on the scale of projects, but many opt for at least $1 million in additional protection.

Contractors invest heavily in equipment, labor, and client trust. The right combination of insurance ensures those investments remain secure. With so much on the line, you can’t afford to cut corners on business insurance.

General Liability Insurance Needs to Match Your Daily Exposure

Business owners’ insurance packages cover a range of risks, and general liability insurance should never follow a one-size-fits-all model. Your daily operations determine the type and amount of exposure you face. Whether you’re interacting with customers, entering client properties, or managing a crew on a job site, your policy needs to reflect the real conditions of your workday. Matching insurance coverage to actual risk ensures you’re protected when it matters most.

Understanding Daily Business Activities

Your daily exposure depends on where you work, who you serve, and what you do. A retail store sees constant foot traffic, increasing the risk of slip-and-fall accidents. A general contractor may cause accidental property damage while working offsite. Even businesses that work online still face advertising injury or reputational risks. These situations call for general liability insurance packages that align with your business interactions.

Why Policy Limits Should Reflect Reality

Many business owners stick with the default limits included in starter policies. While these may seem sufficient, they can fall short in real-world scenarios. If your business frequently deals with the public or high-value projects, low policy limits may not cover medical bills, legal fees, or settlements. An independent agent can assess your daily exposure and recommend limits that protect your business from costly surprises.

Industry-Specific Coverage Considerations

Each industry carries unique liability concerns. For instance, a landscaping business may need coverage for property damage and injury on client sites. A marketing agency might prioritize advertising injury protection due to content creation and publication risks. An experienced agent understands these distinctions and adjusts the policy to your industry profile, so your business insurance makes sense for how your business operates.

Risks That Vary by Business Model

Even within the same industry, business models can change risk levels. A café with a dine-in option faces different risks than one focused on delivery. A home-based consultant may need lower limits than a firm with office traffic and employees. Your general liability insurance should grow or adjust with your business, reflecting shifts in operations, locations, or client interaction.

Customizing General Liability With Endorsements

Tailoring your coverage often includes choosing the right endorsements. These are a few of the most common:

Premises liability for in-store accidents

Completed operations for work done offsite

Personal and advertising injury for reputation-based claims

Medical payments for minor injuries without lawsuits

Fire legal liability for rented property

How Independent Agents Match Coverage to Risk

Independent agents take time to understand your business routines and compare coverage options from multiple insurers. They’ll ask about staff size, service types, equipment use, and customer contact to develop a full picture of your exposure. This process helps them recommend a policy that protects your real-world operations, not just theoretical risks.

General liability insurance is only effective if it matches how your business works. By tailoring your policy to your daily exposure, you reduce uncertainty and create a stronger foundation for growth. With the right guidance, you’ll be prepared for risks you expect—and for the ones you don’t.

How Business Insurance Supports Vendor and Client Trust

Building trust with vendors and clients takes more than great service. It requires proof that your business is reliable, professional, and financially protected. Business owner’s insurance plays a vital role in that trust. It signals that you’re prepared for setbacks, committed to industry standards, and able to uphold your responsibilities. Whether you’re signing a vendor contract or bidding for a client project, insurance shows that your business can be counted on.

Meeting Client Contract Requirements

Clients often require proof of insurance before they sign a contract. This is especially true for general liability insurance, which protects against claims of bodily injury or property damage. When a client sees you have active coverage, they know that if an accident occurs, they won’t be left carrying the cost. This assurance makes clients more likely to choose your business and continue working with you over time.

Demonstrating Stability to Vendors

Vendors want to work with partners who pay on time, maintain operations, and follow through on commitments. Business insurance helps convey that your company has the structure and financial backing to withstand disruptions. It also ensures that if a covered loss affects your operations, you’re more likely to recover quickly and keep up with payments or service timelines.

Providing Proof With Certificates of Insurance

A certificate of insurance (COI) is one of the most important tools for communicating coverage. This document outlines your policy’s limits, effective dates, and types of insurance. Many clients and vendors request a COI as part of their onboarding process. It gives them the confidence to move forward, knowing that your business has protections in place.

Reducing Risk for Business Partners

When vendors or clients enter an agreement, they’re also accepting risk. Insurance reduces their exposure by acting as a financial buffer in case of an accident, mistake, or unforeseen event. This is especially important in industries with physical workspaces, large inventories, or professional service obligations. Great business owners’ insurance includes general liability, property, or errors and omissions coverage, demonstrating that you’re doing your part in risks.

Add-Ons That Strengthen Confidence

Some coverages go beyond basic requirements and help reinforce confidence in your business. Coverages may include:

Professional liability for service-based businesses

Workers’ compensation can protect employees with injury claims

Cyber liability for data security and online transactions

Business interruption insurance for supply or operations delays

Inland marine for goods transported between locations

Using Insurance as a Relationship Tool

Having the right coverage isn’t just about compliance. It’s a communication tool. It allows you to say to your partners, “We’ve taken steps to protect everyone involved.” This mindset can be the difference between winning a contract and missing out. It also fosters long-term loyalty, because your partners know they’re working with a company that values security and shared success.

Business insurance does more than cover risks. It gives vendors and clients a reason to believe in your professionalism and your ability to deliver. With the right plan in place, you create strong partnerships built on transparency, responsibility, and trust.

General Liability Insurance That Covers Real World Claims

General liability insurance is a comprehensive part of a great business owner’s insurance package. It covers many of the risks that come with interacting with customers, working on client property, or advertising your services. But the real value of this coverage becomes clear when a real-world claim occurs. From slips and falls to property damage or defamation, general liability insurance keeps businesses financially stable when problems arise.

Covering Injuries on Business Property

One of the most common claims involves customer injuries that happen at a business location. Whether it’s a client tripping over an uneven floor or slipping on wet tile, these incidents can lead to expensive medical bills and legal fees. General liability insurance helps pay for the injured party’s medical costs, your legal defense, and any resulting settlements. Without it, one accident could overwhelm a business.

Handling Damage to Client Property

Contractors, cleaners, delivery companies, and other service providers often work at customer sites. If your employee accidentally breaks a valuable item or damages part of a home or office, you could be held responsible. General liability coverage applies to these situations by covering the cost of repairs or replacements. It also helps cover legal fees if the client decides to pursue a lawsuit.

Responding to Advertising-Related Claims

Marketing carries its own set of risks. If a competitor claims your ad campaign caused reputational damage or used protected content, general liability insurance can respond. The policy covers advertising injury claims, including libel, slander, and copyright infringement. This protection is essential in industries where branding and competition are intense.

Addressing Customer Lawsuits and Settlements

Even if your business hasn’t made a mistake, you can still be sued. Legal costs are high, and defending a case through trial can strain your resources. General liability coverage provides legal defense and court costs, helping you respond effectively to claims that may not even result in a payout. It gives you the freedom to focus on business while your insurer manages the legal process.

Common Add-Ons That Expand Coverage

Most general liability policies offer optional endorsements to cover additional risks. These can include:

Product liability for businesses that manufacture or sell goods

Contractual liability to cover obligations in signed agreements

Hired and non-owned auto liability for employee vehicle use

Liquor liability for establishments that serve alcohol

Fire legal liability for damage to rented or temporary property

Meeting Real-World Needs With Tailored Coverage

Business insurance should be designed for company-specific risks. A tech firm and a landscaper both need general liability insurance, but the kinds of claims they face are very different. Independent brokers help you select a policy that fits your work, your clients, and your budget. They explain policy language in plain terms and help adjust limits for maximum protection.

General liability insurance is about more than meeting a legal requirement. It protects your business from the costs and disruption of real-world claims. With the right coverage, you’re prepared to handle the unexpected and continue serving your customers without missing a step.

General Liability Insurance Requirements for Contractors

Contractors face unique liability risks that make business owners’ insurance a critical part of staying compliant, competitive, and financially protected. When you operate in construction, renovation, or specialty trades, general liability insurance is often more than just a smart precaution—it’s a legal requirement. From client contracts to licensing boards, the demand for valid, active insurance continues to grow. Understanding the essentials helps you avoid penalties and build trust with customers.

Minimum Coverage Expectations

Most states don’t set a fixed national standard, but many require contractors to carry general liability insurance to maintain their license or bid on public work. Typical policies include at least $1 million in per-occurrence coverage and $2 million in aggregate limits. These thresholds reflect the potential for major damages from accidents, injuries, or property destruction on job sites. Higher-risk trades or larger contracts may require you to increase those limits for work qualification.

Policy Inclusions That Matter

At its core, general liability insurance covers third-party claims of bodily injury, property damage, and personal or advertising injury. In the construction field, that could mean anything from a client slipping on your tools to accidentally damaging a structure during renovation. Some policies also include coverage for completed operations, which helps protect you after the project wraps if a problem emerges.

Documentation and Client Requirements

Contractors are often asked to show proof of insurance before signing a contract or starting work. This comes in the form of a certificate of insurance (COI), which confirms your policy details, coverage limits, and active status. Commercial clients, general contractors, or property owners may also request that they be added as an additional insured. Doing so extends some of your liability protection to them and helps reduce their risk of legal exposure.

Additional Protections Contractors Should Consider

While general liability is the foundation, it’s not the only insurance contractors need. Certain job types, client agreements, or state laws may require extra coverage to operate legally and protect your business. These can include:

Workers’ compensation for employee injuries

Commercial auto insurance for vehicles used in your work

Contractor’s equipment insurance to protect tools and machinery

Umbrella policies to increase liability limits

Professional liability if you offer design or consulting services

Having these layers in place helps you bid confidently and comply with contract terms without leaving coverage gaps.

Why Independent Agents Help You Stay Compliant

Working with an independent insurance agent ensures you’re not guessing when it comes to contractor insurance. These professionals have access to multiple carriers and understand industry requirements, especially for trades with evolving standards. They help match your policy to your business size, work type, and local rules, ensuring that every requirement is met without overpaying for unnecessary features.

If your contracting business relies on trust, timely delivery, and professionalism, don’t let insurance be the weak link. A tailored general liability insurance policy keeps you legally protected and ready to work, no matter the size of the job, the complexity of the site, or the type of project you take.

How General Liability Insurance Covers Advertising Injuries

Advertising your business comes with real legal risks, and not all of them are obvious. Business owners insurance can cover more than just slips and falls, protecting you from what’s known as advertising injury. When a business faces claims of libel, slander, copyright infringement, or misrepresentation, this coverage may help offset the legal and financial consequences. If your marketing efforts unintentionally harm another party, the right policy can make all the difference.

What Advertising Injury Means

Advertising injury includes several types of harm that result from how your business promotes itself. Claims might involve damaging a competitor’s reputation, using copyrighted images without permission, or even slogans that resemble another company’s branding. These claims fall under the personal and advertising injury portion of general liability insurance. Without this protection, you could be forced to pay legal costs or settlements out of pocket.

Real-World Examples

These risks aren’t just theoretical. A small business that posts a negative comment about a competitor online could be sued for defamation. A startup that unknowingly uses stock images without proper licensing might receive a copyright violation notice. Even a harmless product comparison could spark a lawsuit if the other company sees it as misleading. Advertising injury claims target small and midsize companies more often than you might think.

Defamation and Slander

You don’t need to intend harm for defamation or slander to become an issue. A simple social media post or promotional flyer that criticizes another business can open the door to legal action. General liability coverage helps with the cost of defending against these claims, which can be expensive and time-consuming, even if the statements made were accurate.

Issues With Marketing and Media

Today’s marketing channels include websites, emails, podcasts, and videos. With more platforms come more risks. Claims can stem from how you use music, publish interviews, or frame competitor comparisons. One mistake can result in a costly claim. General liability insurance helps you respond quickly and protect your reputation in legal matters.

Intent vs. Impact

Intent doesn’t always matter in advertising claims. Even if you didn’t mean to infringe on a trademark or cause harm, courts may still side with the injured party. This makes it critical to have a policy that includes advertising injury coverage. It ensures that you’re not financially vulnerable just because something slipped past your team or a third-party vendor.

Policy Limits and Exclusions

Not every general liability policy is the same. Advertising injury coverage may have limits separate from bodily injury or property damage protection. Some policies exclude specific types of content or platforms. Make sure you understand how your coverage works, what’s excluded, and what your limits are. An independent insurance broker can walk you through the details so you’re not caught off guard.

Advertising can help your business grow, but it also exposes you to legal risks you might not anticipate. General liability insurance that includes advertising injury protection helps you focus on your message without worrying that one campaign could lead to a financial setback.

Evaluating Insurance Needs When Launching New Products or Services

Launching something new is exciting– and introduces substantial risks. Whether you’re adding a product line, expanding into new markets, or offering a new service, your insurance needs will likely change. Business owners insurance gives you a solid foundation, but it must be reviewed to match your expanded exposure. Without that step, one overlooked risk could jeopardize your growth.

General liability insurance remains essential during any launch. A new product could lead to unexpected claims or service issues. If someone gets hurt, or your offering causes damage, that policy helps protect your business from lawsuits and financial loss. But coverage isn’t automatic– your insurer needs to know what’s changing.

Understand What’s Changing and What It Means

Each addition to your business changes your profile. New products may be made in different facilities, shipped to new areas, or involve unfamiliar suppliers. New services may involve different customer interactions, new tools, or higher liability exposure. These changes affect how your insurance policy responds. Updating your coverage makes sure the new elements are included and protected.

Changes in Staffing and Operations

Expanding may mean hiring short-term staff, leasing new space, or acquiring more equipment. Your insurance must reflect those changes. For example, general liability insurance should cover all locations where the new product or service will be sold or performed. If equipment use expands, your property coverage needs to grow too. Don’t wait until your next renewal to make those changes– adjustments can be made mid-policy.

Business Owner’s Insurance Evolves with You

Your business owner’s insurance policy combines property, liability, and often business interruption coverage. When launching something new, your limits may need to increase. You might also need new endorsements, especially if you’re taking on contractual obligations or entering a new industry segment. Reviewing your policy before the launch allows time to make changes.

Product Liability and Professional Liability

A new product brings the potential for product liability exposure. Even small defects can lead to claims. A new service– especially if it involves advice, installation, or repairs– may require professional liability coverage. These aren’t always included in basic policies. An independent broker can help you evaluate these needs and add the right protections before the launch.

Adjust for Contracts and Vendors

Some product launches involve vendor agreements, franchise expansions, or new partnerships. Those contracts often require specific insurance coverage or proof of limits. Make sure your policy meets those terms, or the deal could fall through. Business owners’ insurance is flexible enough to be adjusted, but only if you plan efficiently.

Establish Independent Support

Independent insurance brokers help you review changes, match new risks to appropriate coverage, and shop for the best carrier fit. They make sure your general liability insurance and business owner’s policy reflect your new direction. That support helps your launch go smoother and prevents insurance issues from derailing progress.

Growth should never come with guesswork. By reviewing your insurance when launching something new, you make sure your investment is protected and your business stays ready for what comes next.

Preparing for Seasonal Business Fluctuations with Proper Coverage

Seasonal changes affect your schedule and reshape your commercial business risks. Whether your business slows down in the winter or ramps up during summer, your insurance coverage needs to match those changes. Business owner’s insurance helps protect you year-round, but it works best when it reflects your actual activity level. Reviewing your policy before each busy or slow season helps you avoid gaps and keep your costs in check.

General liability insurance is essential no matter the season. It protects you from claims tied to customer injuries, property damage, or advertising issues. But other parts of your coverage– like property limits, inventory protection, or temporary staff coverage– may need seasonal adjustments. Making those updates early can help prevent delays and coverage shortfalls when your operations shift.

Seasonal Risk Exposure

Every business faces different challenges depending on the time of year. A landscaping company may need more coverage in spring and summer. A retail shop may face higher theft risks during the holidays. Your business owner’s insurance should account for those fluctuations. If your policy doesn’t reflect your seasonal activities, you may be overpaying during slow months or underinsured during peak periods.

Temporary Staff and Liability

Many seasonal businesses hire part-time or temporary workers. If your policy doesn’t list these employees correctly, claims may be denied. General liability insurance can help protect you from injury claims tied to seasonal staff– but only if the policy is structured correctly. Your broker can help you confirm who’s covered and recommend updates based on your seasonal hiring patterns.

Inventory Increases and Coverage

If you boost inventory ahead of a busy season, make sure your limits cover the full value. Standard policies may be based on average inventory levels, not seasonal spikes. If something happens– like a fire, theft, or water damage– you could be left covering the difference out of pocket. Review your property coverage and consider adding a seasonal increase endorsement if your inventory levels vary widely.

Protecting Equipment During Downtime

Some seasonal businesses store equipment during the off-season. Make sure that property remains covered, even when it’s not in use. Theft, weather damage, or vandalism can happen at any time. Storing items off-site? Verify that your coverage extends to those locations. Check your business insurance and ask your insurance broker for clarification.

Premium Adjustments and Flexible Policy Terms

Some insurance providers offer flexible payment structures or adjustable policies that align with seasonal income. You may be able to lower certain premiums during slower months or adjust coverage levels without canceling your policy. These options can improve your cash flow without sacrificing protection.

Independent Brokers Help You Stay Ahead

Seasonal planning goes beyond schedules– it includes managing financial and legal risks. An independent insurance broker reviews your full exposure and makes sure your general liability insurance and business owner’s policy reflect your busiest and slowest times.

Your business changes with the seasons. Your insurance should too. By reviewing your policies and proactive planning, you keep your operation protected– and positioned for long-term success.

General Liability Insurance vs Professional Liability Insurance

When it comes to business owner’s insurance, knowing the difference between general liability and professional liability insurance is key. Both policies shield you from costly legal claims– but they cover very different types of risk. Understanding how each one works helps you choose the right coverage and avoid the mistake of assuming one policy does it all.

General Liability Handles Physical Accidents

General liability insurance covers third-party claims for bodily injury, property damage, and personal injury. That means if a customer slips in your store, or your team accidentally breaks something at a client’s site, this policy steps in.

Professional Liability Covers Service Mistakes

Professional liability– often called errors and omissions (E&O)– covers financial loss caused by mistakes or oversights in your work. If a client believes your advice, design, or planning caused them harm, this policy provides protection. It’s essential for professionals in consulting, law, finance, design, and other service-based industries.

When You Might Need Both

Some businesses face risks in both areas. Take an architectural firm: they may need general liability to cover office injuries and professional liability for design errors. Many companies choose to carry both policies to cover their full range of exposure, especially if they handle both physical work and client advice.

Real-World Examples

Here’s a quick breakdown of common claims for each type:

General liability:

A customer trips over your equipment and breaks a bone

Your employee damages a client’s furniture while working on-site

A competitor sues over your advertising content

Professional liability:

A financial advisor gives poor advice that leads to losses

A software firm delivers code that causes a client’s website to crash

A marketing consultant misses a deadline, resulting in penalties

Different Triggers, Different Protections

General liability claims usually result from physical incidents– things that happen on-site or during day-to-day operations. Professional liability, however, is tied to how well a service was performed. Even if nothing is physically damaged, a client’s financial loss can still trigger a claim.

Which One Does Your Business Need?

If you run a retail shop, construction company, or café, general liability is likely your top priority. If you provide services like IT, accounting, or consulting, professional liability should be on your radar. Businesses that straddle both worlds often need both types to stay fully protected.

Contract Requirements Can Guide Coverage

Many contracts require specific insurance. A client might ask for proof of professional liability before signing off, or a government project might require general liability with minimum limits. An independent insurance agent can help you understand these terms and secure the best coverage policies.

How Coverage Limits Work

General liability typically separates limits for bodily injury and property damage. Professional liability usually has a per-claim limit and an overall annual cap. Many E&O policies are “claims-made,” meaning they must be active when the claim is filed– not just when the work happened.

Understanding the difference between general liability and professional liability isn’t just about meeting requirements– it’s about staying protected where it matters most.

Common Misconceptions About General Liability Insurance

General liability insurance is a must-have for most businesses, but it’s not always well understood. Many business owners assume it covers everything or that having a policy means they’re fully protected. Unfortunately, those assumptions can lead to gaps that only become clear when it’s too late. Understanding what general liability does– and doesn’t– cover helps you make smarter choices and avoid costly surprises.

You’ll Likely Need More Than One Policy

Most businesses need more than just general liability. Depending on your work, you may need additional protection like cyber liability, professional liability, or umbrella coverage. Business owner’s insurance is a starting point— but not a complete strategy.

It’s Not a Catch-All Policy

General liability covers third-party claims like injuries, property damage, and advertising harm. But it doesn’t cover everything. It won’t protect you from employee injuries, damage to your property, or mistakes in your professional services. If you rely on this policy alone, you may find yourself unprotected in key areas.

Not Every Claim Will Be Covered

Just because you have a policy doesn’t mean every incident results in a payout. If a claim falls outside your policy’s terms– like something caused intentionally or tied to a contract dispute– it likely won’t be covered. Knowing what’s excluded is just as important as knowing what’s included.

It Doesn’t Cover Employee Injuries

A common misconception is that general liability also covers your employees. It doesn’t. Workplace injuries require workers’ compensation insurance, which is legally required in most states. Without it, you could face lawsuits, fines, and uncovered medical costs.

Professional Mistakes Aren’t Included

If your business provides advice or services, general liability won’t protect you from claims of errors or poor performance. That’s what professional liability insurance is for. Without it, a client alleging a costly mistake could put your business at risk.

Policy Limits Matter

General liability policies come with financial limits– both per claim and overall. If you’re hit with a large lawsuit or multiple claims in one year, your coverage could run out. As your business grows, it’s important to review those limits and adjust them to match your risk level.

Home-Based Businesses Still Need Coverage

Running a business from home? Don’t count on your homeowner’s policy to protect you. Once business activities are involved– like a client visit or damage to customer property– homeowners insurance won’t apply. General liability tailored for home-based businesses fills this gap.

Certificates of Insurance Don’t Tell the Full Story

Having a certificate of insurance (COI) may be enough to get a contract, but it doesn’t show the full scope of your coverage. It only proves a policy exists– it doesn’t confirm what’s covered or how much. Make sure your COI aligns with your obligations.

General liability insurance is vital, but it’s not enough on its own. Understanding its limitations– and pairing it with other coverage– helps ensure your business is protected where it counts. An independent insurance agent can help tailor a plan that fits your operations and gives you real peace of mind.

The Impact of Business Insurance on Client Trust

Trust is the foundation of any successful business relationship. Clients want to know they’re working with professionals who not only deliver results but also take responsibility when things don’t go as planned. That’s where business owner’s insurance plays a bigger role than most people realize. It’s not just about protecting your assets– it’s about showing that your business is prepared, responsible, and committed to doing things right.

Why Clients Want to See Proof

Clients– especially those in service, construction, or consulting– often ask for proof of insurance before signing a contract. They want to know that if something goes wrong, they won’t be left with the bill. Showing that you carry general liability insurance, property insurance, or even errors and omissions coverage gives them peace of mind. It sends the message that you’re professional and serious about your work.

Insurance Adds to Your Reputation

Having insurance doesn’t just protect you– it reflects how you run your business. Clients tend to trust insured businesses more because they know you’re likely to follow safety procedures, follow legal guidelines, and manage risks properly. For larger jobs or long-term contracts, having the right coverage can be a deciding factor. Insurance is often a condition for getting hired.

It Helps You Win Business

Competitively, insurance can give you a big advantage. Promoting your coverage can set you apart from uninsured competitors and help you secure contracts faster. Many corporate or government clients require insurance before they can approve you as a vendor. Having the right policies in place can help you move through their approval process with fewer delays.

Clients Want to Avoid Legal Hassles

When something goes wrong– like an employee damaging property or a service delay causing losses– your insurance helps shield your client from liability. They won’t have to worry about footing the bill or dealing with legal fallout. That kind of protection builds trust and allows both parties to focus on the job instead of potential problems.

Policies That Give Clients Confidence

The most common insurance types clients look for include:

General liability for injuries or property damage

Professional liability for service or performance issues

Property insurance to protect your equipment

Cyber insurance for data protection and digital risks

Workers’ comp to cover employee injuries

Staying Reliable in a Crisis

Insurance also helps you recover faster if there’s a setback. If damage, theft, or an accident puts your work on hold, the right policy can help you stay on track. That kind of consistency reassures clients that you’ll be able to deliver, even when challenges arise.

Be Transparent in Your Agreements

Including insurance details in your contracts shows clients you’re upfront and prepared. Some may ask to be listed as “additional insured,” which is easy to handle through your agent. This step clears up confusion and shows that you take accountability seriously.

Insurance does more than protect– it helps build client relationships based on trust, transparency, and responsibility. When you show you’re covered, you’re also showing that you’re dependable from day one.

Common Business Insurance Claims and How to Avoid Them

Unexpected events can derail even the most organized business. While business insurance helps protect you from serious losses, filing a claim can be stressful, slow, and expensive. Understanding the most common business claims– and how to prevent them– can help you avoid trouble before it starts.

Injuries on Your Property

Slip-and-fall accidents are among the most common independent insurance agency claims. Wet floors, poor lighting, or uneven sidewalks can lead to injuries and lawsuits. General liability insurance can help cover costs, but prevention is your best defense. Keep walkways clean, use warning signs during cleaning, and make sure entrances and exits are well-lit.

Insuring Against Fire and Weather Damage

Property damage from fires or storms can shut down operations. Faulty wiring, lightning, or heavy winds can all cause major losses. Regular safety inspections, working smoke detectors, and reviewing your coverage limits help reduce risk and speed up recovery if something does go wrong.

Theft and Burglary Coverage

Stolen inventory, cash, or equipment hurts your bottom line and disrupts workflow. Insurance can help recover losses, but good security is essential. Install surveillance cameras, alarm systems, and limit access to sensitive areas to help prevent break-ins and make insurance claims smoother.

Workplace Injury Claims

Employees hurt on the job– whether from lifting, slipping, or repetitive strain– can lead to workers’ comp claims and higher premiums. You can reduce injuries by offering proper training, using ergonomic tools, and enforcing safety protocols. A culture of safety also boosts morale and trust.

Cyberattacks and Data Breaches

Cybercrime is on the rise, and small businesses are frequent targets. Phishing scams, ransomware, and data theft can lead to legal trouble and lost revenue. Cyber liability insurance covers many of these risks, but firewalls, employee training, and regular software updates are your first line of defense.

Dealing With Product or Service Mistakes

If your product causes harm or your service falls short, your business could face a lawsuit. Manufacturers should perform quality checks, while service providers should keep clear records and maintain high standards. Professional liability insurance helps protect against these claims when things go wrong.

Vehicle Accidents on the Job

Businesses that use vehicles regularly– whether for deliveries or fieldwork– face added risk. Commercial auto insurance covers damage and injury claims, but safe driving policies, background checks for drivers, and regular vehicle maintenance help prevent accidents in the first place.

Equipment Failure and Repair

When critical equipment breaks down, your business may grind to a halt. Equipment breakdown insurance helps cover repair costs and income loss. Even better? Regular maintenance schedules and a plan for temporary replacements can minimize downtime.

Contract Disputes

Disagreements with clients or vendors over payments or services can lead to costly legal battles. Avoid these headaches by putting everything in writing, reviewing contracts carefully, and setting clear expectations from the start.

Independent insurance agents help you assess your exposure and adjust your coverage as your business grows. With a smart prevention strategy and the right insurance, you can protect your business and move forward with confidence.

How to Get Great Coverage for a Home-Based Business

Getting the right insurance for your business can be confusing. That’s where an independent insurance agency can help, but to choose the best policy, you still need to understand what you’re comparing. Business owner’s insurance can protect your building, equipment, income, staff, and more. To compare quotes well, you need to look beyond the surface.

Start by Understanding Your Business’s Unique Risk Profile

Every business has different risks. A food truck faces different dangers than a printing company. Before comparing quotes, list your business activities, locations, and assets. Think about cyber exposure, customer traffic, and employee tasks. A good quote should match your exact risk level. If it doesn’t, it’s not the right fit– even if the price is low.

Match Policy Types to Your Operations

Many businesses start with general liability insurance bundled with other coverages. But if you offer delivery services, store customer data, or work in high-risk areas, you’ll need more. Compare quotes that include optional add-ons like cyber insurance, employment practices liability, or inland marine coverage. These extras fill gaps that a basic plan may leave open.

Pay Attention to Claims Handling and Support

Some insurers are faster and easier to deal with than others. When comparing quotes, ask about the claims process. Who handles it? How long does it take? Does the company offer 24/7 support? Some carriers use digital claims tracking, while others still rely on paperwork. Efficient service can make a big difference during a stressful situation.

Check for Business Interruption Coverage

A fire or storm could close your business for weeks. Does the quote include business interruption insurance? This helps cover lost income and operating costs while you rebuild. Not all quotes include this, and the coverage amounts can vary. If you depend on daily revenue, this protection is critical.

Look at the Insurer’s Financial Strength and Industry Focus

Not all insurers are equal. Some specialize in certain industries and offer more targeted protection. Others might have strong financial ratings but little small business experience. When comparing quotes, research the company behind the policy. A carrier with solid ratings and knowledge of your field results in fewer surprises.

Ask These Focused Comparison Questions

Does the policy include lawsuits or customer injuries?

Is cyber liability part of the quote or extra?

How is inventory loss handled after a break-in or disaster?

Are contractors, temps, or volunteers covered in this plan?

Does this quote include legal defense costs?

Use an Independent Insurance Agency to Find Hidden Value

An independent insurance agency will examine your needs, suggest better options, and explain complicated terms. They can also identify discounts, bundling opportunities, and underused coverages. This guidance makes it easier to compare policies side by side with clarity and confidence.

Not all insurance plans offer easy changes. Some charge high fees for adjustments or increase rates sharply each year. Use expert support, ask the right questions, and choose a policy that covers more than just the basics– so you’re protected through every stage of your business journey.

Types of Insurance Available from Established Independent Agencies

Established independent agencies provide a broad range of insurance solutions that protect businesses from various risks and help maintain smooth operations. These agencies offer personalized service, ensuring that you receive coverage tailored to your specific industry and risk profile. With the guidance of an experienced independent insurance agent, you can build a business owners insurance package that meets your unique needs.

Understanding Business Insurance Options

Business insurance includes many types of coverages designed to shield different aspects of your operations. For example, property insurance protects your physical assets such as buildings, equipment, and inventory. Workers’ compensation covers employee injuries, while commercial auto insurance protects vehicles used for business purposes. General liability insurance guards against claims of negligence, and additional specialized policies may address cyber risks or data breaches. By combining these coverages, you can create a robust safety net that minimizes financial losses.

Tailoring Your Insurance Package

A key strength of independent insurance agencies is their ability to design insurance packages specific to your industry and business size. For many small and mid-sized businesses, a well-structured package might include protection for physical assets along with coverage for common risks. For instance, ensuring that you have the appropriate level of general liability insurance is a cornerstone of any effective bundle.

Here are some key elements that companies often bundle together:

General liability insurance – Covers third-party injuries, property damage, and legal fees.

Business owners – Combines property and liability into one convenient policy.

Workers’ compensation – Provides coverage for employee injuries and lost wages.

Cyber liability – Protects against data breaches, hacking, and cyber threats.

Commercial auto – Ensures coverage for business vehicles.

Streamlining Claims and Customer Service

One of the major advantages of working with an independent agency is the exceptional customer service and claims handling they provide. When a claim is filed, the process is usually faster and more straightforward because your agent understands your business and its specific risks. This personalized attention helps reduce downtime and minimizes financial disruption during stressful events. A simplified claims process eases the administrative burden and builds confidence among stakeholders.

Cost Efficiency and Long-Term Savings

Bundling multiple insurance policies together can lead to significant cost efficiencies. When you combine various coverages under one package, you often benefit from lower premiums and reduced administrative fees. This bundled approach not only saves money in the short term but also lays the foundation for long-term financial stability. As your business grows, a flexible, cost-effective insurance plan is essential for sustained success. Regular reviews with your independent agent help ensure that your coverage adapts to evolving risks.

Established independent agencies offer a variety of insurance types tailored to meet your business’s unique risks. They provide cost-effective solutions that combine essential policies with specialized coverages to build a robust risk management strategy. With the help of an experienced agent, you receive personalized guidance that adapts to your evolving needs—ensuring every element, from physical property to digital assets, is well protected. Embrace the expertise available from these agencies to secure a stable, well-insured future for your business.

Essential General Liability Insurance Tips for Small Businesses

Running a small business comes with risks, and the right insurance is key to protecting your investment. Many owners assume general liability insurance is optional, but it is often a requirement. This coverage protects against third-party claims, such as property damage and bodily injuries. Without it, a single lawsuit could put your business in financial trouble.

The Importance of Business Owner's Insurance

Business owners insurance is essential for protecting small and mid-sized businesses from financial loss due to unexpected events. This policy combines general liability and commercial property insurance, offering broad coverage in a single package. It helps cover legal costs, property damage, and business interruptions caused by disasters or lawsuits. Many landlords and clients require businesses to carry this insurance before signing contracts. Without it, a single claim could result in significant financial strain, potentially leading to business closure. Business owner's insurance also provides peace of mind by safeguarding assets, employees, and operations. By bundling key coverages, it offers a cost-effective solution for businesses looking to minimize risks.

Key Coverage Areas of General Liability Insurance

General liability policies cover several key areas that protect businesses from common risks. It provides coverage for third-party bodily injuries, such as medical expenses and legal fees if a customer slips and falls on your property. It also includes property damage liability, which pays for damages caused to someone else’s property due to business operations. Another critical area is personal and advertising injury, which protects against claims of defamation, libel, or copyright infringement in marketing materials. Additionally, general liability insurance covers legal defense costs, even if a lawsuit is frivolous. Many landlords and clients require proof of this coverage before signing contracts, making it a vital policy for businesses of all sizes.

How to Lower Business Insurance Costs

Lowering the cost of business insurance requires strategic planning and risk management. Comparing quotes from multiple providers ensures you get the best rates. Bundling policies, such as general liability and property insurance, can lead to discounts. Increasing deductibles lowers premium costs but requires financial preparedness for claims. Implementing workplace safety measures reduces accident risks, leading to lower premiums. Maintaining a strong claims history also helps secure better rates. Regularly reviewing and updating coverage ensures you are not overpaying for necessary business protections.

Common Mistakes to Avoid When Buying Business Insurance

Many small business owners make costly mistakes when purchasing insurance. One common mistake is underestimating coverage needs, which can lead to financial losses. Another is failing to read policy exclusions, resulting in unexpected coverage gaps. Some business owners also buy the cheapest policy without considering the quality of coverage. Working with an experienced insurance agent helps avoid these pitfalls.

Securing the right insurance is one of the most important steps in running a small business. General liability insurance provides essential protection, but it’s only part of a comprehensive plan. Business owner's insurance offers additional security by combining multiple coverages into one policy. Working with an independent insurance agent helps small business owners find affordable, customized solutions.